Spot On: Balancing Forecasts and Reality

I expected Spotify to lay out a clear path to profitability at their recent investor’s day. Wall Street has been anxious and in many ways I understand why. We are 10+ years in and Spotify still hasn’t consistently turned operating profits. While I expected Spotify to lay out a path to profitability, I didn’t expect them to announce a long term goal of $100B in revenue with 40% gross margins and 20% operating margins. These numbers are insane. Let’s dive into what these numbers mean, how Spotify is proposing we get there and whether we should believe these numbers at all.

Napkin Math

Before we start asking a ton of questions, let’s just walk through what would happen if Spotify does hit these numbers. With projections of $20B in operating margins in 2030, that would have Spotify trading at 1x 2030 price to earnings. A far more realistic price to earnings ratio in this situation would be 20x earnings. That would mean a 20x return in 8 years. For reference, Apple has returned 10x in the next 8 years.

Crazy Train

Now the question is, do we believe Spotify can make any of this happen? The answer is simultaneously simple and complicated. Let’s dive into the answers for both.

Simple:

Over the next years, Spotify will more than double their users to 1B and then significantly increase their monetization (all while raising margins).

Complicated:

MAU (users) and ARPU (revenue per user) growth are entwined, so I’ll talk about them together. A key area where MAU and ARPU are impacted is by price increases. As Spotify increases price, it will naturally drive down MAUs, but ideally be an overall positive increase due to higher ARPU. Simply put, 100 users at $20 per user ($2k revenue) is better than 110 users at $10 per user ($1.1k revenue). Over time, Spotify will increase prices to help drive overall revenue higher.

Another key area where Spotify will drive ARPU (and some might argue MAU) is via better targeted ads (dynamic ad insertion). In some ways, targeted ads could lead to a better experience than non-targeted ads. I’d rather listen to an ad on sports gambling than makeup. Improving targeting can lead to better user experience (lower churn = more MAUs) and significant ARPU growth. A further driver in ARPU would be an increased ad load. Podcast listening hours are monetized only 14% of the time, leaving lots of room for increased ad load. Just like price increases, Spotify will need to balance how ad load can drive up ARPU, but also drive down MAUs (via worse user experience). If you are curious on how Spotify balances these decisions, see the LTV (long term value) section of their investor day.

Spotify will continue to develop new verticals to enter. They started as a music company, then eventually entered the podcast business. Currently they are entering audiobooks and live audio (Spotify Live). After dominating music and podcasts, Spotify has shown the ability to enter and innovate new markets. About half of the monetization Spotify is forecasting will come from these new verticals. This is a huge assumption and frankly a scientific wild ass guess. Spotify doesn’t hide that with this illustration on the left (I provided the meme on the right).

Spot On: What Evidence do we have Spotify Will Hit These Goals?

Spotify does have a strong operating history. They innovated the music industry, then dominated the podcast industry in an amazingly quick fashion. Every big swing Spotify has taken, they’ve hit. That doesn’t mean that will continue though.

We can also use their past investor day as a measuring stick for whether they can hit their targets. These goals from 2018 were largely obtained.

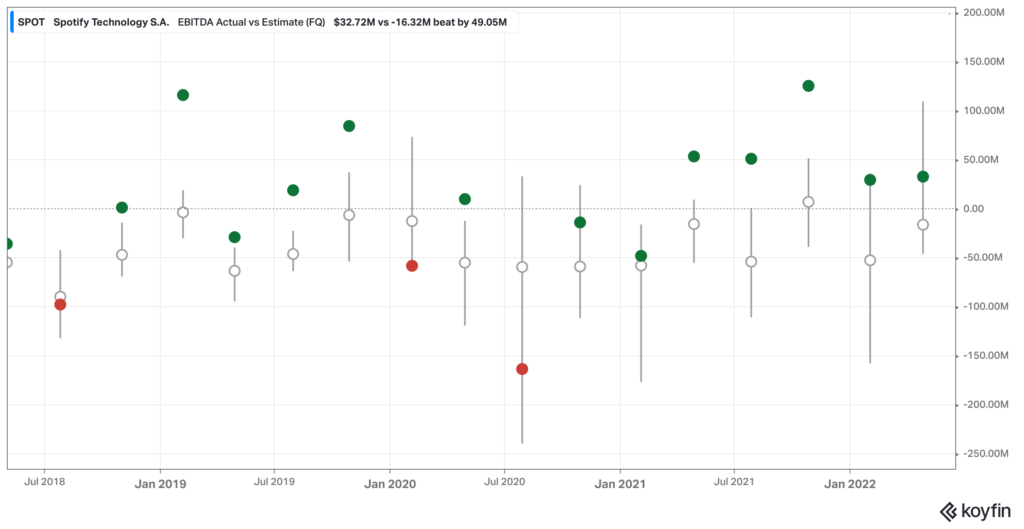

Furthermore, Spotify has historically hit their quarterly guidance. Spotify has met or exceeded their user/subs guidance 90% of the time. Forecasting a quarter vs a decade is a huge difference, but many companies can’t even forecast a quarter.

During their investor day, Spotify made 8 mentions of the “Spotify Machine”. Essentially, they believe that through music and podcasts, they have the ability to quickly and successfully enter new verticals. Objectively, I think this is true. They’ve dominated the music scene. Then systematically dominated the podcast scene. Can these successes be applied to new areas? Spotify believes so.

Wrapping it Up

I doubt Spotify hits $100B in annual revenue with 20% operating margins but that really doesn’t matter. Even if they hit half of that operating margin, the stock would be a 10x from here. In reality, these numbers don’t mean anything. Any forecast a year out is an exercise in throwing darts and we are forecasting a decade out.

I wouldn’t recommend anyone buy the stock based on these forecasts. I love Spotify, but I hate forecasts even more. Positive forecasts are better than negative forecasts, but that is about as much faith as I put into forecasts. If this forecast caught your interest, dive into the business (start HERE and HERE) and take the forecast with a grain of salt.

I’m still incredibly bullish on Spotify, but not because of this forecast.