A Big Bite: Why Apple is Risky

A decade plus of domination has made many Apple bulls believe they are immune to risk. The below commentary on iPhone led me to this line of thought, which got pushback from a lot of Apple bulls along the way.

The problem with the iPhone is you’re now in mature business. Pretty much everybody has a smartphone. You’re very dependent on upgrades and keeping this business going. With Apple, the problem is you’ve essentially built a $3 trillion, $2.5 trillion company now on a single product. And I think from that perspective, it’s probably more danger than a Google or a Facebook, because any failure on the part of that single product is going to have consequences that are monstrously large. I mean, imagine an iPhone 14 that nobody wants to buy. And I don’t even want to think about the consequence, but that could be disaster, because that’s 75% of your revenues and profits right there.

Aswath Damodaran on Invest Like the Best

Let’s dive into what Aswath is saying and expand a little on why I’m a little bearish on Apple.

Why Apple Will Fail

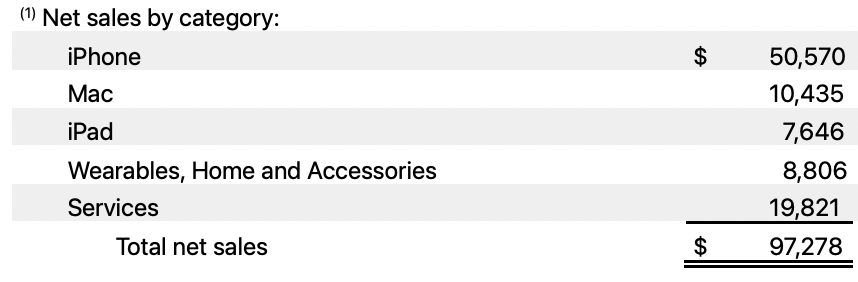

I think it’s fair to say Apple is an iPhone company. Sales in iPads are declining and services is largely driven by the iPhone. Wearables are booming, but I’d argue that is partially because of the iPhone ecosystem (and if iPhone sales drop, wearables will follow).

I think if you accept that the iPhone is a singular point of failure, it starts to change the way you think about Apple. When I look at what Aswath was saying, I see data to support it. They are an iPhone company. Apple does have huge moats, but some of that is offset by a single point of failure (and a mature business). Making hardware is hard and if Apple ever oversteps the line or just misses the boat, I’m not sure they will recover.

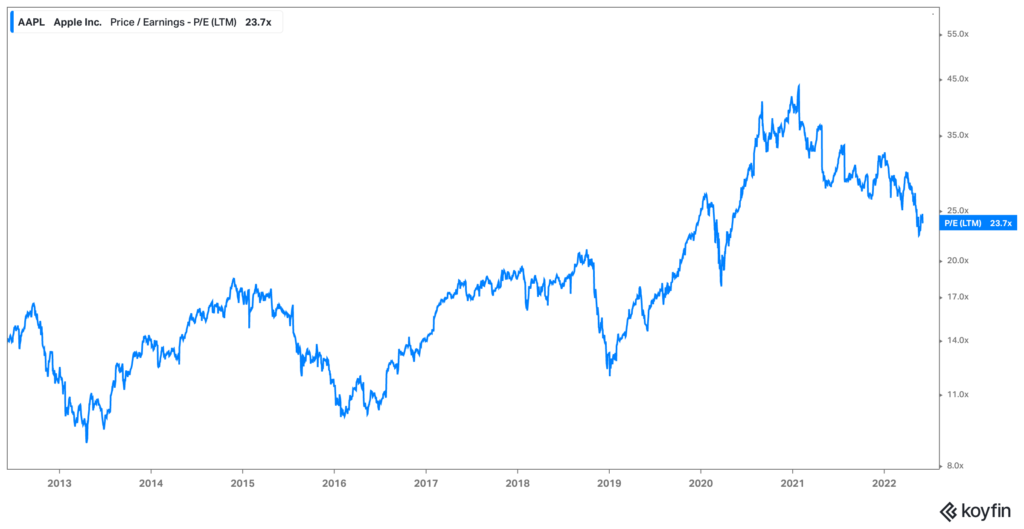

Furthermore, despite a recent pullback, Apple is still trading at historically high valuations. A company with limited growth trading at a high valuation is a dangerous combination. Layer in supply chain constraints and you might have significant problems.

A certain part of my bear case for Apple is just that they are the largest company in the world. I don’t put a lot of weight into this, but historically the largest market cap companies haven’t stayed there for long. Apple isn’t like these companies, but I still think many of the factors that led to the demise of other top companies do apply to Apple.

Why I’m an Idiot

There are lots of valid counterpoints to this single point of failure theory. Apple is flush with cash and can readily overcome a short term hit to sales. They also have an extremely strong history of making hardware. Even if Apple makes a dud iPhone, they can correct on the next model which usually comes in a year or so. On top of this, Apple has objectively huge moats.

I get all of these points, but they don’t make the risk go away. Apple is clearly a great company, but as investors we need to be looking forward, not backward. When I try this with Apple, I don’t se a clear path.

The Big Apple Question

I come back to the question, does Apple have more upside potential or downside potential? Honestly, I don’t know. I wouldn’t short it, (IT’S A CULT, never short a cult), but I might mess around with some puts. Risk is what you don’t see and I think a lot of people have their eyes closed.