The Rise of the Dragon: A 100 Year Portfolio

I don’t know about you, but I have no clue what is going to happen next year, not to mention tomorrow. If you asked me a year ago whether Russia would invade Ukraine or inflation would exceed 8%, I would have bet strongly against that. Yet, here we are. I’m an optimist, but sometimes shit just hits the fan.

Bad times are always lurking around the corner. From COVID to war, we don’t know what can send the market tumbling next. Why not invest in something that will be resilient in the face of all turmoil?

Enter the Dragon

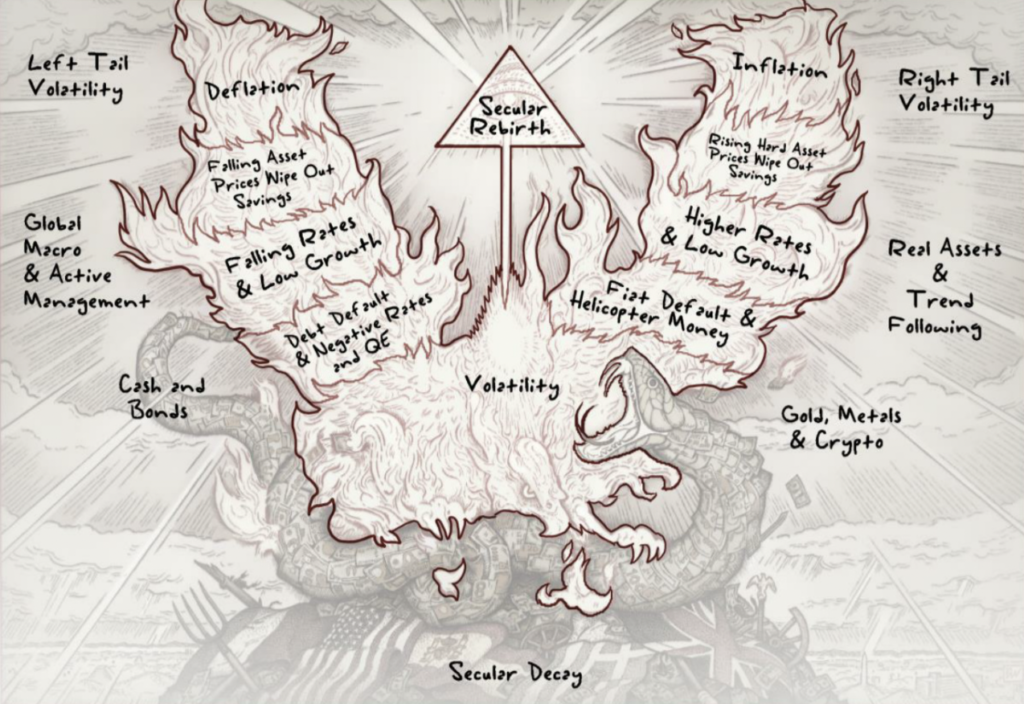

The Dragon portfolio describes itself as a 100 year portfolio. A portfolio that will provide strong performance with minimal drawdowns. Similar to the All Weather portfolio, the Dragon takes a slightly different approach focusing how to survive a number of different situations from inflation to deflation to just general batshit craziness.

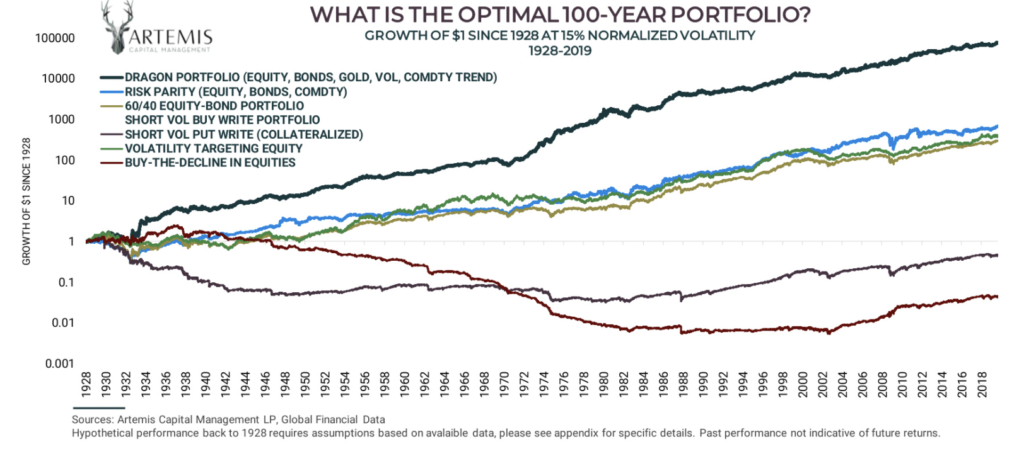

The returns are eye popping when you first see them. Some of this is a little misleading, but I do see some interesting aspects of the Dragon that are worth diving into.

What’s the Catch?

Significant upside with limited downside? Sign me up! Unfortunately everything comes at a cost.

The Dragon portfolio attempts to solve a problem that really hasn’t existed in a long time. Stocks and bonds have been ripping for 40 years, so many investors have decided to base their entire investing strategy around only those two assets. When you invest in the Dragon portfolio, you are planning for events that haven’t happened in recent memory.

On the surface, investing primarily in stocks (with a little bit of bonds) makes sense. These have by far the highest returns and I’m young. However, the more I look at this, I wonder if this is recency bias. With the past few years being so crazy, I’m definitely open to the idea that the past 40 years might not be the best representation of the next 40. Let’s dive into what makes the Dragon different.

Fundamentally, this portfolio is very similar to a lot of risk averse portfolios, but includes commodity trend following and long volatility. Neither of these are topics retail traders are fairly confident around. Let’s dive into what those mean and how they can help benefit the average investor.

Long Volatility

Long volatility is confusing, but the easiest explanation I see is that it is portfolio insurance. For a small fee, you gain an uncorrelated asset that helps ease situations where everything is going wrong.

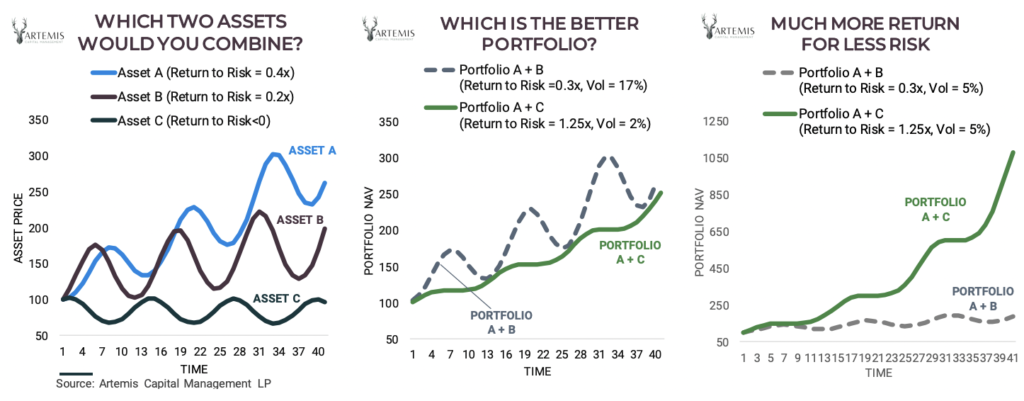

When I first started looking at assets like these, the idea of allocating capital to lower returning assets, seems dumb. However, the math behind it tells a different story. If you rebalance and own two assets that aren’t positively correlated, the lower returning asset can actually increase returns! The math behind it is a little complicated, but the simple explanation is that rebalancing creates a buy low, sell high effect which allows the lower returning asset to actually increase returns.

One of the problems with long volatility is that people only talk about it during bear markets (I’m guilty of this right now). If you want to allocate to long volatility in it, the allocation needs to be permanent. Far too many people change valid strategies at the least optimal times (buy long volatility at the bottom, then sell it at the top). Long volatility is magic, it just needs patience.

Trend Following

I’m not a huge fan of trend following, but for commodities, I get it. When commodities start to fall up or down, it is generally driven by a larger event (think supply chain woes or increased demand). Trend following allows you to catch these major movements. However, trend following generally requires active trading (constantly buying and selling), which takes more work than I generally want to do. Luckily, programs exist that automatically allow this to be done.

How Do I Become a Dragon?

One of the programs I’ve played around with is composer.trade. This will automatically allow you to rebalance and execute the commodity trend following. If you browse their website, you can find the dragon portfolio as one of the first advertised. When you dive in though, you’ll find that their version is using triple leverage on stocks and bonds and a few other creative interpretations.

The easiest way to become a dragon is to do it through Artemis Capital, but this would require being an accredited investor (basically you need to be a millionaire). The fees won’t be cheap either, but they do bring a whole different level of sophistication that almost all other investors can’t achieve.

Am I a Dragon?

Personally if I was to implement this, I’d reduce some of the leverage and might tweak the long volatility formula. I do like the idea of the dragon portfolio, but I am still researching before I implement it. If you are interested, I recommend you read the paper, it’s a different style of reading, filled with mythological references and plenty of unique art. If this is all a little… much, check out the all-weather portfolio or Swensen porfolio.

P.S – if you like Composer.trade, play hard to get after signing up and they’ll offer to fund your account with $300 for signing up!