January 2021 In Review: Storm the Capital then Squeeze the Hedges

January began with the storming of the capital and ended with WallStreetBets raiding hedge funds. It’s been a wild start to 2021. My portfolio returned +$25.5k (+10.25%) driven by $SFIX, $BTC, $TDOC and $ETSY.

Moves

Buys – $FB, $AMZN, $PTON, $PINS, $SFIX , $SPOT and $GME Calls

Sells – $FUTU Calls, $BABA Calls, $GME Calls, $PENN Calls

Stock Commentary (>99% of portfolio) – I added to my core positions. I bought $FB ahead of and after earnings. $FB is trading at value, despite bursting with optionality. The market is missing on this one and I’ll own long term. I don’t expect multiple expansion, but I’ll happily take returns driven by revenue growth. $AMZN is my highest conviction holding. It has been trading flat for the past 6 months of a bull market. I don’t care. It’s a great company and I’ll keep adding. $PTON is a monster in the making. I’ll keep slowly adding. $SFIX is a high reward/medium risk play. $SFIX has been flying high, but I’m still very comfortable with the valuation. $SPOT is still my favorite stock. I probably have too much, but as I work on my write up, I couldn’t help but buy more.

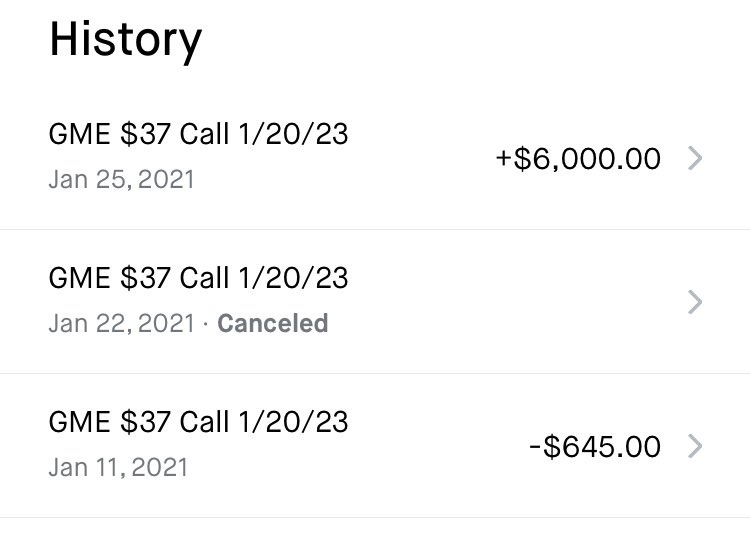

Options commentary (<1% of portfolio) – I accidentally walked into an insane $GME situation. On Jan 16th I wrote on $GME and how I saw and respected diverging views of the same company. It turns out those diverging views would lead to a remarkable short squeeze. I never fully believed in $GME (and still don’t), but I did buy call options that accidentally led to the squeeze. I would have made 10x more if my call options hadn’t been two years out, but I can’t complain. I also sold call options on $FUTU, $BABA and $PENN. My only current option holding is $SKLZ.

What I Learned

As you can tell, I just keep buying my core positions. If I listened to the masses, I would have been in cash 8 of the past 12 months. But going to cash just doesn’t make sense and January is another example of why. You never know when or how the crash will come. Pretending to just lowers your returns. I get the allure… I really do, but the market moves in funny ways. Stop trying to time the market and start making money. Let’s invest.

Why is Spotify your favorite stock?

I believe that Spotify is uniquely positioned to dominate a huge industry. Young management, a proven track record, a huge TAM, optionality and 350 million users. On top of all of this, the market is scared by the low margins of the music industry, driving a very reasonable valuation. Eventually, the market will learn that Spotify isn’t a music company they are an audio/media/ad company. I love the risk vs return.