Spotify: Breaking the Sound Barrier

Sometimes the best investments are hidden in plain sight. Spotify is everywhere at this point. Concerns around margins have dragged the stock down, but low margins are just a part of an impressive story.

The Obstacle is the Way

Spotify ran the gauntlet. They beat Apple, Amazon and Google in the music streaming industry. The largest tech companies, all flush with cash, couldn’t stop Spotify. All had significant hardware advantages and huge network effects. Spotify overcame all of that and more to become the leader in music streaming. All of this while charging significantly higher rates. Competition strengthened Spotify and prepared it for the future to come.

Not only did Spotify beat some of the most impressive companies in the world, they did it while driving a whole new industry. For a hot minute, digital downloads were the big thing. Streaming is clearly more user-friendly. Physical and downloads still represent $6.9B in opportunity for Spotify.

All Wrapped Up

Spotify’s Wrapped went viral this year. Wrapped is Spotify’s year end review where they recap your most-listened-to artists, songs, playlists, podcasts, etc… But that really is just the start. Spotify also rolled out stories, quizzes, badges and options to share on social media. Wrapped is a great representation of Spotify and their brand.

“And we keep building on it — taking data storytelling to new heights to make each year’s recap more special than the last.”

Spotify

The Spotify brand is real. COLLINS has a behind the scene view of Spotify’s brand, which helps retain users and increase pricing power and user engagement. Another layer in defense against Spotify’s tech rivals.

“When an individual makes a personal connection with a song, their reaction is to cry, cheer, scream, sing, jump, or get chills — or, as we phrased it, “burst” with emotion. Our identity graphically captured that moment.”

COLLINS on developing the brand identity of Spotify

Sneakily High Switching Costs

I’ve been playing our top songs from the previous few years on Spotify. The history is amazing. My fiancée regularly says, “Who made this playlist, every song is a straight banger!” Ironically, of course—the reality is that it’s just her listening history plus sneakily good data science. You can’t take that history with you. Some apps claim to transfer your playlists, but it’s hit or miss and doesn’t take the Spotify-created playlists. Customers for life.

The Future is Sound

Audio is a way bigger market than anyone realizes.

“Video is about a trillion dollar market. And the music and radio industry is worth around a hundred billion dollars. I always come back to the same question: Are our eyes really worth 10 times more than our ears? I firmly believe this is not the case.”

Daniel Ek in Audio First

A simple test of the importance of audio versus visual is which bothers you more; fuzzy audio or fuzzy video? Most would agree audio. I believe Spotify is the leader in audio. Eventually audio will be a trillion dollar market, and Spotify is in prime position to capitalize on this.

Game Theory and Podcasts

Spotify has faced stiff competition and come out on top. However, it really isn’t a fair fight. Apple doesn’t want to be an ad company since everything revolves around the iPhone and it goes against their position in data privacy. Apple has a small ad business (app store and browser), but I doubt they ever go to the freemium model. They do have a huge advantage with the app store and music/podcasts coming natively downloaded on all iPhones, but that hasn’t stopped Spotify. Apple won’t do ads to the level Spotify will and that has held them back historically and will continue to going forward. Apple has one arm tied behind its back and Spotify is willing to engage in guerilla warfare.

The freemium model has proven effective in the music industry. Listeners can come and experience the app for free, before eventually becoming subscribers. However, this doesn’t really work for podcasts. Apple doesn’t charge for podcasts. How can Spotify become an aggregator for podcasts if they don’t have the freemium advantage? Once again, ads are the key. Spotify is becoming the dominant audio company and a huge factor in that is being the leading audio advertising company. Dynamic insertion will be essential here. For Apple podcasts, any ads are inserted by the podcaster and are therefore the same for every listener. For Spotify podcasts, Spotify can dynamically insert ads targeted specifically to the listener. Dynamic ads demand significantly higher cost per ad inserted (leading to more revenue). All of this means podcasters will make more money on Spotify than anywhere else. This all ties into the Megaphone and Anchor acquisitions. Podcasters will want to be on Spotify.

Spotify is uniquely positioned in an extremely competitive space. It is stuck between music labels on one side and tech behemoths on the other, and at first glance it appears Apple, Amazon, and Google will continue to drive the music industry margins lower. But as you dig deeper, Spotify is in a much better competitive situation. Apple has its hands tied on ads and Amazon isn’t truly interested in the space (and years behind). Spotify is in the early stages of dominating the audio industry.

Optionality

Spotify has a user base of 340 million that it’s actively trying to leverage into new revenue streams. Spotify benefits from autocatalysis. Podcasts are just one of many opportunities. Long term, Spotify is also looking to become the premier audio advertising company—the Facebook or Google of Audio. It is secretly an audio/media/ad company, people just haven’t realized it yet.

The Financials

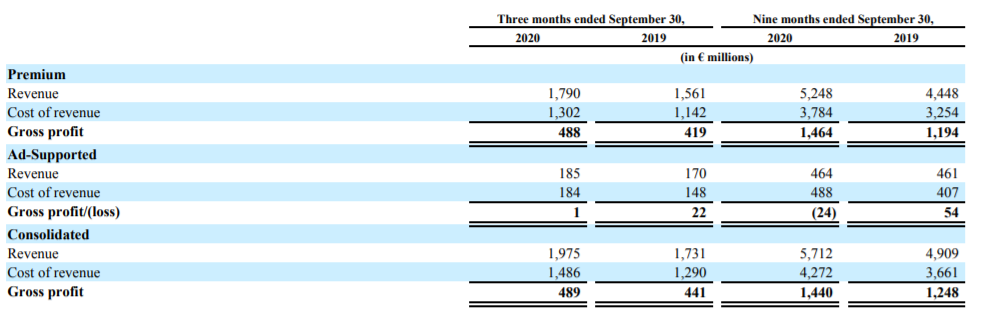

Spotify really doesn’t make money off of their ad-supported users, in fact they lose money on them. Long term that might change as Spotify becomes more of an ad company, but right now it’s the reality. On premium customers, margins are higher at 28%. These aren’t tech margins, they are grocery margins. Between the artists, the label and the platform there isn’t a lot of money left. In the long run I do think that Spotify has the means to lift music margins, and podcast margins should be significantly higher.

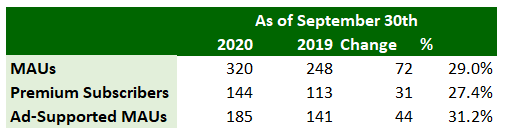

While the user base is huge at 320 million users, the growth is still strong at 29%. One key item in understanding user growth is that premium subscribers account only for 45% of users, but 90% of revenue.

The balance sheet and cash flow are clean.

Conclusion

Spotify is my largest holding (behind Bitcoin). I believe that Spotify is uniquely positioned to dominate a huge industry. Young management, a proven track record, a huge TAM, optionality and 350 million users. On top of all of this, the market is scared by the low margins of the music industry, driving a very reasonable valuation. Eventually, the market will learn that Spotify isn’t a music company they are an audio/media/ad company. I believe Spotify is a generational investing opportunity.

3 thoughts on “Spotify: Breaking the Sound Barrier”

Comments are closed.