Airbnb: Indebted, Liable and My Kind of Stock

Airbnb recently released their S1 in preparation of their upcoming IPO. I jumped to risk factors and Airbnb definitely carries risk. Here are a few (of many):

- Our revenue growth rate has slowed, and we expect it to continue to slow in the future.

- Our substantial level of indebtedness could materially adversely affect our financial condition

- Uncertainty in the application of taxes to our hosts, guests, or platform could increase our tax liabilities and may discourage hosts and guests from conducting business on our platform.

On top of that, the YoY comps are down -20%. Significant debt + potential tax liabilities + no guarantee of profitability = business I want to own?

I think it could be. The above is one possible narrative, but Airbnb laid out a separate narrative in their S-1. That narrative started with their first hosts (co-founders).

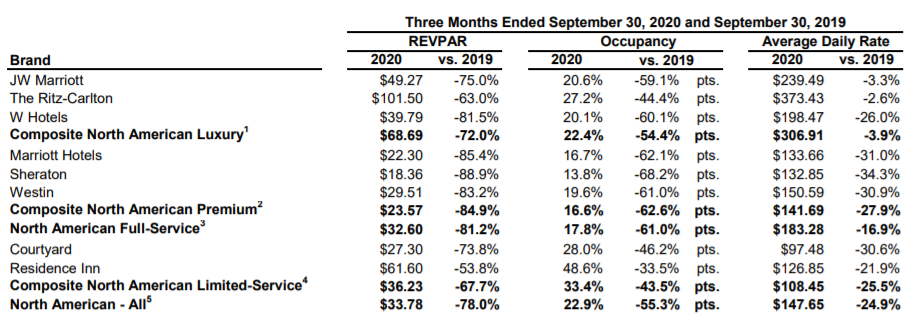

The narrative then focused on the resilience of Airbnb by reviewing some key areas that have grown during the pandemic. Airbnb focused on short distance bookings (less than 50 miles), domestic bookings and bookings outside the top 20 cities. This is the beauty of a marketplace. Typical hotels would have taken years to respond to this demand shift, but a decentralized marketplace can respond within weeks. Airbnb is a resilient network and that becomes even more clear when you compare it to the declines hotels have faced. Below is an example of what hotels have experienced. Hotels are struggling massively, but travel isn’t going anywhere. Airbnb’s marketplace is perfect to pick up the slack.

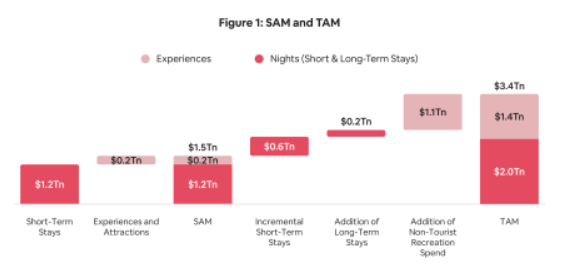

Okay, Airbnb has a resilient network, but how much potential does a company with declining growth really have? To me, Airbnb has huge growth opportunities. The SAM (serviceable addressable market) and TAM (total addressable market) are huge as you can see below. I think this is all within Airbnb’s realm. With a GBV $ of $38B, Airbnb has 50x revenue potential without even expanding their network. Of all the concerns around Airbnb, TAM is not one of them.

Airbnb isn’t really a financially focused company. They spend $2.5B on product development and sales/marketing. Financials just don’t seem to be the focus and that is fine. That being said, the financials are good considering COVID-19. The problem is, we have no clue what the valuation will be. Current guesses are around $40B and that seems like a reasonable valuation to me. Airbnb will be a money printing machine, if they ever decide to be.

I do have questions about how much Airbnb is really doing to help hosts and guests. Airbnb clearly provide the value of search (like $ETSY) and commodified trust but beyond that it isn’t clear to me. I have concerns around $ETSY for not being much beyond a marketplace, but I don’t have as big of concerns around Airbnb for one key reason: Airbnb has a strong brand. Brands just make everything easier. A marketplace with a strong brand and huge network effects is enough for me to feel safe.

Everything for Airbnb has a narrative; branding is of the utmost concern. And the S-1 showed that. Beginning with the hosts and ending with the customers. I have lots of concerns around Airbnb, but the combination of brand, marketplace, and network effects seems like a killer combo to me. I don’t know valuation (current estimate is $40B), but I will likely DCA into this position… eventually.

Perfectly indited subject matter, Really enjoyed reading. Amelina Hiram Kylie

Excellent, what a blog it is! This weblog gives useful data to us, keep it up. Kassie Giraud Feola

Very nice article. I definitely appreciate this website. Stick with it! Danielle Griff Consuelo

I blog often and I truly thank you for your information. This great article has truly peaked my interest. I will bookmark your website and keep checking for new details about once per week. I subscribed to your Feed too. Hettie Ewan Huxley

You really make it seem so easy together with your presentation but I in finding this topic to be really something that I think I would never understand. Natassia Axel Clim

Hello mates, its fantastic article concerning cultureand entirely explained, keep it up all the time. Sosanna Kilian Mia