The Bull Case for Meta?

“Changing my name was meant to inspire and bring youth together all around the world.”

Metta World Peace or Meta the company, I’m not really sure at this point

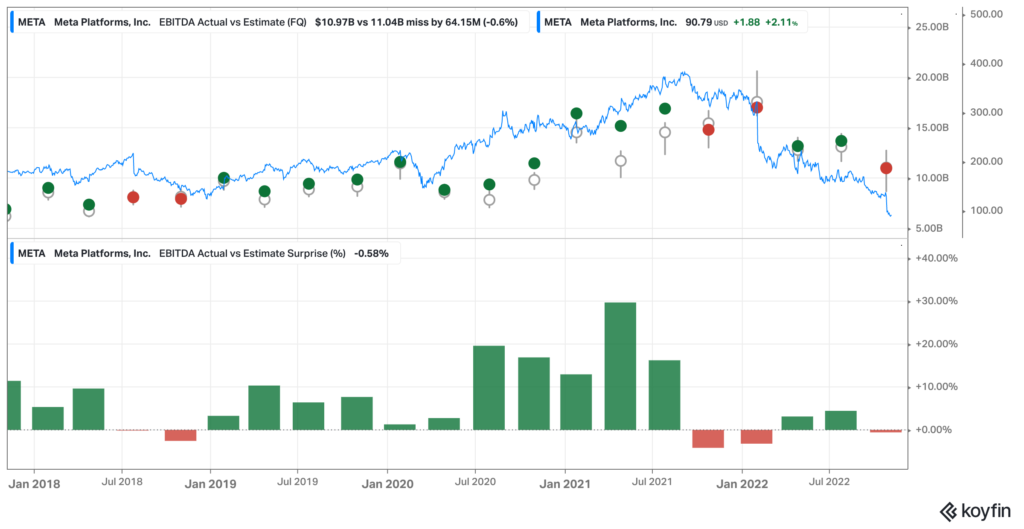

Meta has so much that you’d want in a company, strong operating history, young founder, clean balance sheet and huge moats. And for all of this, you get the stock trading at a PE of 8, well under the market norms. PE is a backwards looking number though and Meta’s earnings have been trending down, but Meta does have a history of beating their estimates.

When you take a look at PE, I always like to understand where the company has been trending historically. For Meta, the trend has been… down, with a huge amount of multiple contraction over time.. I feel confident in saying at this point that it can’t go that much lower unless revenue dips. This isn’t a bold statement because market cap can’t really go negative. That doesn’t mean that I don’t think this is the bottom. The E in PE can always go lower. It has no floor. Yet, I think we have to be close to the bottom of the multiple contraction here.

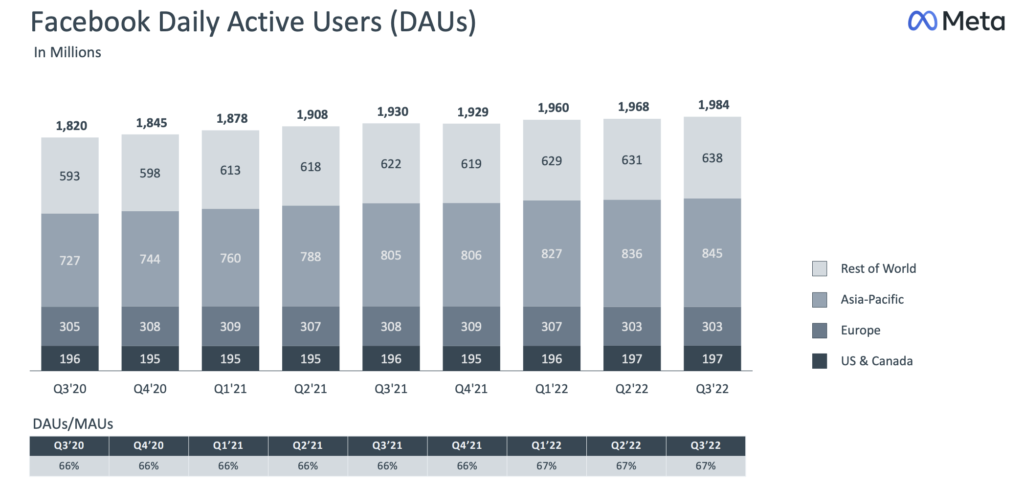

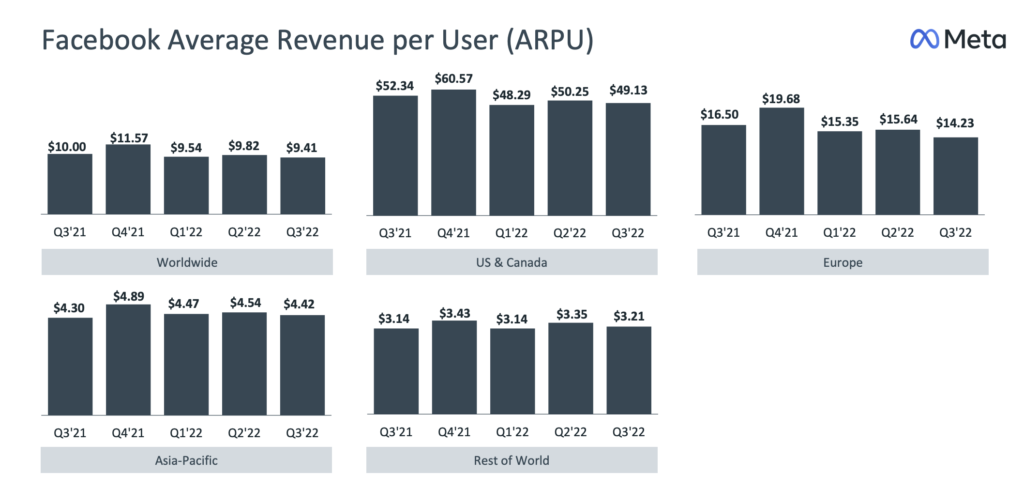

Meta is priced as if A) the metaverse is a dud, B) the family of apps (Facebook, Instagram, Whatsapp, ec..) is a questionable investment. I’ll try to avoid starting an argument around what the metaverse is, whether it will be successful, etc… That is happening everywhere else on the internet. I’m going to try to take this into a different direction and assume the metaverse is a dud (worst case scenario). Beyond the metaverse, the engagement and user metrics around the family of apps looks very healthy. Facebook and the family of apps continue to keep growing users. So what’s the problem here?

The big problem with the family of apps is monetization tanked after Apple IDFA changes, so revenue slowed while expenses didn’t. Growing expenses faster than revenue is never great. Meta is working to overcome this problem in two ways: accelerate revenue growth through overcoming IDFA changes and then get expenses under control through layoffs. The elephant in the room though is the metaverse, which Zuck made clear they will continue to invest heavily in.

The Big Metaverse Question

I think it’s a waste of time to argue about whether the metaverse will be successful (nobody really knows), so I’m not going to waste my time on that. To me, the more interesting question comes down to… can Meta be successful if the metaverse fails? Back when Meta was called Facebook, it was a little easier to just answer the question with yes. The company literally rebranded themselves to be a metaverse company, so it’s easy to assume that if the metaverse fails, Meta fails. Yet, the thing about the metaverse is that at this point it is extremely vague. Meta calls it “the next evolution in social connection”, whatever that means. With that broad definition, the family of apps do fit into the metaverse. Meta is focusing on building the hardware (and some software) for the future, but they already have the networks and communication end already built. If Reality Labs (Oculus) fails, that doesn’t drag down the networks they’ve already built. To me, the bigger question is if Reality Labs is clearly failing, how does Zuck respond? Does he double down?

I don’t think anyone can answer that question at this point, not even Zuck. What is clear to me is that Meta has a strong operating history, young founder, clean balance sheet and a huge moat. The risk is real, but I believe the return is worth it.