Brands to Watch

I love brands. They create pricing power and a moat for companies, which is an extremely powerful combination. The problem is, most of the time, the brand is priced in already. At times, the market starts to act funny and think brands are dying. Lets take a look at some great companies and try to find if the charts back up my ideas.

Combo Multiplier

Before we do that, I think it’s important to talk about everything that goes along with the brand. Whether it be network effects, high switching costs or something else, buying companies that have stacked these traits has been very profitable. In rare cases, these traits all stack up creating powerful forces driving a stock. Charlie Munger calls this a Lollapalooza effect. An example could be Starbucks combining a strong brand with a dopamine product (people are madly addicted to coffee) and secular tailwinds in fancy coffee. As I start to look out for brands to watch, this is something I have in mind.

Brands to Watch

I’m starting a list of brands that I think should be trading at a premium because of their brand (and a number of other factors that create possible Lollapalooza effects). Other brands could be something like WD40, which has a sneakily great brand, but not many other items adding to its Lollapalooza effects (that I can see)

Apple

I’m sort of an Apple bear, but much of that comes down to price. I’d be a bull if it were trading at its historical multiples, but Apple has gone through a steep multiple expansion of ver the last few years. From trading at a PE multiple of 5 to 25, is a wild swing for a mega-cap. I’d argue 5 was too cheap and 25 is too expensive.

I’ll keep my eyes on Apple, because of their brand. I am bearish in many ways, but not on their brand.

Starbucks

Starbucks has a lot going for it. People are addicted to coffee and Starbucks isn’t cheap. Starbucks is known for being a high-quality option that is available everywhere. They have billions of dollars of customers’ cash just sitting in the app. Layer in some reinvestment (international) and growth opportunities (food, etc…) and you have a good investment opportunity.

The blip on the chart is COVID, which dramatically drove down profitability in the short term. When you find a great business trading at an average price, it’s a beautiful buying opportunity. Starbucks might just be a great buy right now.

Lululemon

Lululemon is a company that has been oft doubted but consistently proves people wrong. They do an amazing amount of sales through their storefronts and have been building up online sales. I also see plenty of optionality opportunities as well.

Like many other companies on this list, Lululemon isn’t cheap right now. It’s a good company, it shouldn’t be cheap. I’d just prefer to buy great companies at good prices, not okay prices. I worry right now that this is an okay price and the opportunity cost is too high.

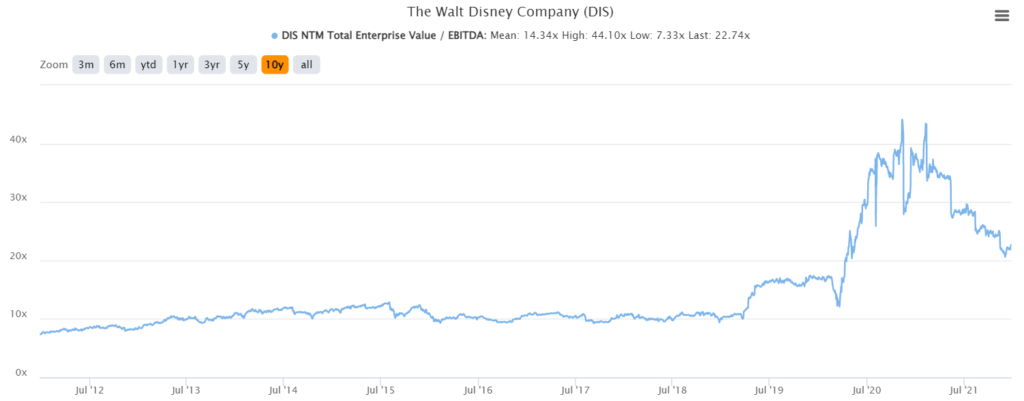

Disney

The problem with Disney is it carries a whole mixed bag of companies within it. From ESPN to Marvel, Disney has a lot going on beyond Disney. Or maybe that’s a good thing. I can’t quite make heads or tails of it. I think of Disney much like I think of Apple. They are in an amazing place with huge moats and plenty of optionality. The problem is that I don’t see great execution historically.

You can see Disney valuation has gone through a wild ride during COVID, with much of that being driven by Disneyland/Disneyworld.

Tesla

I don’t even know what to say about Elon Musk. He’s a volatile genius. Tesla is an amazing company with secular tailwinds and plenty of ballyhooed optionality. They have an amazing band and a cult like following.

I shifted to price to sales here because Tesla hasn’t been consistently profitable and this chart is insane. Seven years of multiple compression undone in a number of months. A swing from a P/S of 1 to 19. It’s truly wild.

Peloton

It never feels good at the time. Buying a tanking stock just feels dumb. When I see other people do it, I always question whether it makes sense, but I’m going to keep buying this dip.

I think Peloton’s brand is real. I’m not sure, it’s still early and a lot of people will argue against the brand. I see strong pricing power, lowish churn, a very high NPS and a cult like following.

In many ways, Peloton is like a mini Tesla. Yeah, Foley is nowhere near Elon, but that might be a good thing. Elon is a powderkeg waiting to ignite. Peloton is at an all time low for P/S. Peloton has a lot of things going wrong for it right now (mostly self inflicted), but I think their brand and management will help see them through this monster dip.

The Secret(s) to Investing in Brands

I’m interested in these companies because I don’t think the markets fully appreciate how strong and meaningful most of these brands are. Right now, all of these beyond Peloton seemed to be pretty well priced in (with the possible exception of Starbucks). Oftentimes, these companies get mispriced when something bad happens, with the markets ignoring the massive moat these companies have to help protect them. I’ll be watching for times like these (right now for Peloton), but then also looking at the Lollapalooza effects.

If you can find a company with a great brand, some other Lollapalooza effects and a great price… buy the f’ing dip!