Cult Brands: Call Your Dad, You Have a Hot Stock Tip

Sometimes, instead of trying to understand something, you make fun of it. It doesn’t make sense, you don’t know why people are acting weird, so we rib ’em. $3k for a bike with an iPad on it… yeah… naw…

But thinking like that is lazy. I want to work to understand, even while I am lazy. But since I am lazy, I need some sort of quick mental models to help navigate that which I don’t understand. To me, one of those key mental models is understanding pricing power.

Pricing power can be driven by a few things: scarce goods, luxury goods, commodity goods and cult brands. Of that list, only commodity goods don’t have pricing power. When looking at stocks, you want pricing power. Peloton is the perfect example as they are a luxury good with brand loyalty and have temporary scarcity! Peloton is loaded with pricing power.

So when I don’t understand why something is so expensive, I start by analyzing pricing power. Scarcity and luxury goods are easy to figure out, but cult brands can be more difficult. How are cult brands formed? How are they maintained? The reality is that cult brands are just a mental model. A reason always exists, but often times it is very nuanced. Take Starbucks for example. Why do so many people go to Starbucks even though it is always busy and relatively expensive? The real answer is so many things (convenience, quality, consistency, etc..), but people just break this down and call it a brand. When all these little things really add up and then get amplified by a community, it becomes a cult brand!

To bring it back to Peloton, it’s easy to just call Peloton a cult brand (that is what I do), but the reality is the cult is driven by something. It’s not irrational. In a time where your health is of the utmost importance, Peloton offers fitness from the comfort of their home. On top of that, Peloton has an extremely engaged community. The cult is very much real, but it is very much driven by something more.

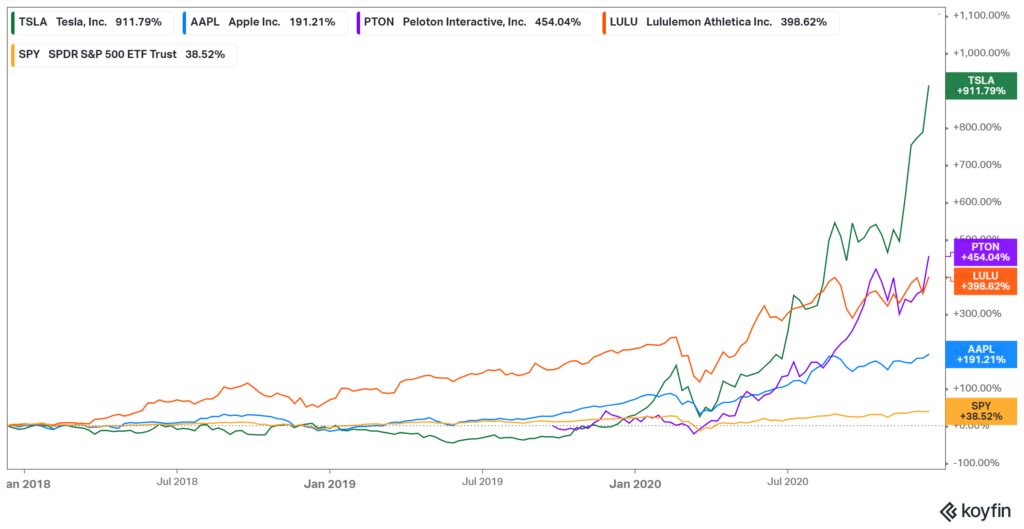

Okay, this is all good and fun, lets talk numbers. Cults go on spectacular runs in bull markets. See below for some common cult stocks recent returns. As you can see, these are far higher than the comparison group of S&P 500. However, you will also see that all these stocks had significant draw downs in March, far lower than the S&P 500. With these high flying cult stocks, the highs are high, but the lows are low. I guess cults don’t have conviction.

Cults are high flying stocks, but remember it isn’t always sunshine and roses. Crazy valuations are the first to pop once the market turns, cult or not. As odd as it sounds, conviction in your cult is needed. Cults and pricing power in general can be used as leading indicators.

The lesson to me is to use cults as a mental tool. When you see something you don’t understand, use your mental models. Cults and pricing power can be a leading indicator of something that should be reviewed. Layering cults/pricing power into your mental framework helps you understand the world better.