Karma Police: Why You Should Never Forget Karma

“That’s a crock of shit. This isn’t a platform. A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it. Then it’s a platform.”- Bill Gates on early Facebook

I’ve been thinking through my investing style. I look for a number of things in businesses (great management, optionality, etc…), but one thing I require in every businesses is the value a company creates be FAR greater than the value it extracts. I call it karma, others call it the Bill Gates line or off balance sheet liabilities. I think karma is simpler, more accurate and catchier.

Why is a positive karma important for a business?

- If value > cost, you have additional pricing power

- Positive karma is generally good for your brand

- NOTE: I consider Facebook to have positive karma (sorry Bill Gates!), but it has a struggling brand

- Positive karma shows that businesses are playing the long game

- Providing value is just a good thing to do!

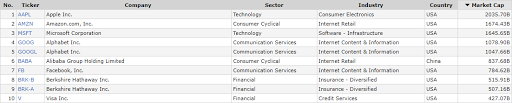

Over time, negative karma will catch up with you. I really don’t want to be anywhere close to neutral karma on my investments. When I look at the top consumer facing names on this list, I think every customer passes this test, with the exception of Visa. Visa got to where they are via a massive moat that very few other companies will ever come close to (plus Visa is actively mortgaging that moat).

Over-extracting value is the natural thing to do for businesses, but it is myopic. I want businesses that have great financials, yet have plenty of value leftover. I’m investing for the long term and I want karma on my side.