Twitter – I’m Torn, I’m all out of faith. Or full of faith. I’m not really sure.

I’ve owned twitter stock. I’ve sold twitter stock. It is a complicated relationship. I just can’t hang onto the stock, something always shakes me. Then, two months later I am back in.

The metrics (mDau – monetizable daily active users) are good. 34% YoY is very strong.

The financials are bad. Revenue down, OpEx up. It is all explainable. Ad revenues are down across many companies, but explainably bad isn’t good.

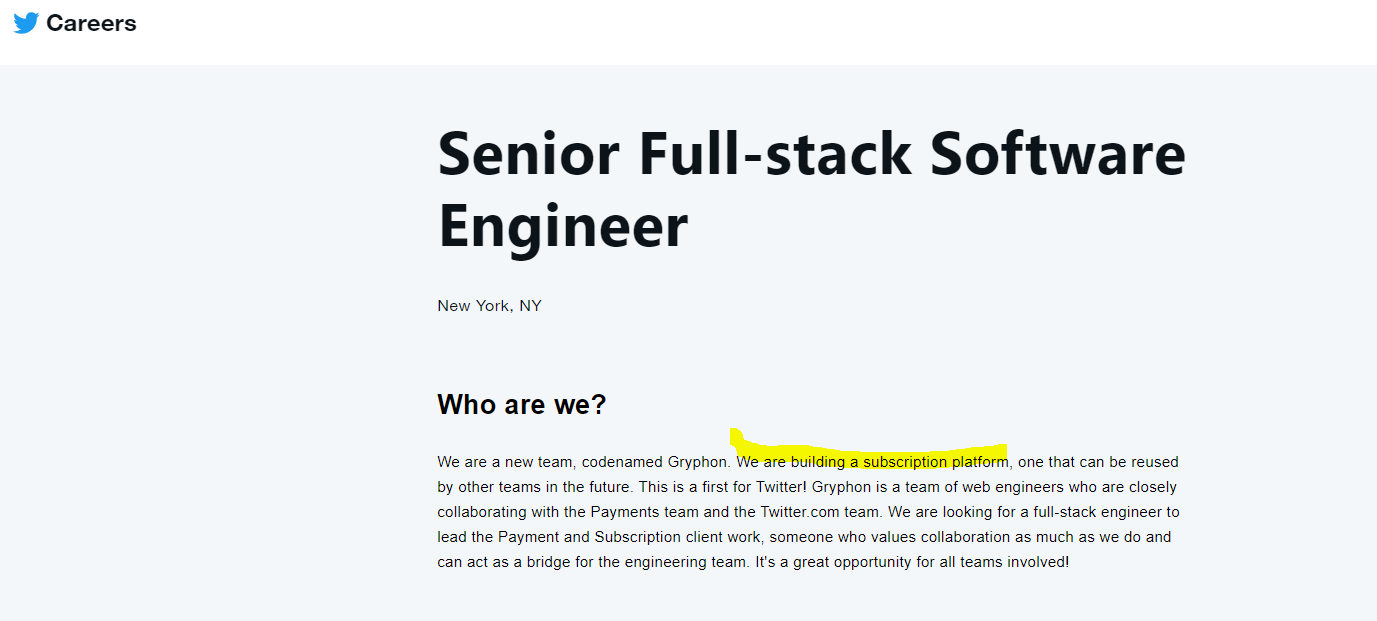

Monetization is the key. Can Twitter make it on ads alone? Yeah, they can be a profitable company. Facebook is a highly profitable company on ads alone, but Facebook is far better at ads than Twitter is or will be. How else can Twitter make money? Some have recommended silly things like charging per tweet, et cetera. Limiting content creation for social media doesn’t make sense. You want to leverage as much free content as possible. The next move for Twitter seems to be a subscription service (Twitter appears to be hiring engineers to build that service now) that would allow additional analytics and some other high end options. Another option would be to offer an ad free version of Twitter.

It all comes back to monetization. Twitter is severely under monetized. Twitter’s market cap is extremely reasonable ($28B vs $1.5B net income in 2019). The market, understandably so, has priced in significant questions around whether Twitter will monetize and whether Twitter will keep growing. That being said, I like the risk/reward. Massive upside, limited downside. A PE ratio of 20 with significant mDau growth is a powerful combo. Twitter is dirt cheap and growing. Maybe its dirt cheap for a reason, but I like what I see.

Obviously, the hack wasn’t good and could have been much worse. Twitter seems to shrug off these crazy situations that keep coming up. A certain kind of resilience allows for this. I think the resilience comes from the user base (much like Facebook).

I don’t own Twitter stock yet, but I will likely start trimming my Square position and shift it into Twitter stock. I’m pro Jack Dorsey, but I have plenty of Jack Dorsey exposure already. Will this time be different, will I hold onto my Twitter stock? I’m going to give this another shot to find out.