Celsius: Too Hot to Handle

I’m a bull, but sometimes you see things so silly that you can’t ignore them. For me, that is Celsius stock right now. Growth investors are going crazy and Celsius has been on a monster run… but are they buying the top of a shitco bull run? Let’s dive in!

A Series of Red Flags

This isn’t my specialty, so no guarantee some of this isn’t dumb. I try to put myself into the future to explain why Celsius would be a terrible investment from this point on. I think this is the case:

Bullshit Marketing

Celsius has historically framed itself as a fat-loss energy drink via “thermogenic properties”. It’s not a secret that green tea/caffeine do have minor thermogenic effects.

“CELSIUS works by combining its clinically proven formula of healthier, energy-boosting ingredients with your own body’s physical activity. It’s a team effort that benefits you in more ways that we can explain (but we’ll do our best). Six published university studies have been conducted on CELSIUS by U.S. accredited scientific research facilities rendering strict scientific standards. To ensure consumer confidence, trust, and industry independence, the studies were all presented at scientific conferences and published in peer reviewed publications. Each one of these studies showed that CELSIUS has thermogenic properties.”

From Celsius website

The problem comes in when you start saying things like this (in studies that you funded):

Celsius have a series of six “studies” on their website that make similar claims, which are blatantly not true. While Celsius doesn’t show this anymore, they historically showed “BURNS CALORIES Up to 100 and More!” on their cans.

They have already lost lawsuits for deceptive marketing, including marketing that they didn’t have any preservatives… which was a blatant lie.

The good news is that Celsius is starting to shy away from this BS marketing. Yet the same leadership team that used that BS in the past is still in charge. Something about shit leopards not being able to change their stripes though. Yet – despite marketing changes, misleading marketing is still following it with many Tik Tok users believing that Celsius contains Ozempic.

A Ton of Marketing Spend

Celsius is trending at approximately 20% of total sales being spent on marketing. For a growing company, this is fine. If growth starts to slow, this could get ugly quick. You can start to get an idea of where Celsius is spending their marketing if you track their Twitter account.

Celsius also had a lawsuit filed against them by Flo Rida as well, with $83M being awarded to Flo Rida. If screwing over Flo Rida isn’t bad luck, I don’t know what is.

“Basically, I helped birth this company, and all we was looking for was some trustworthy people who acted as if they were family and then when it comes down to the success of today, they just forgot about me.”

Flo Rida lolz

Slowing Market Penetration

Beyond a sketchy past, I think one of the key bear cases for Celsius is that their main catalyst (increasing market penetration) is coming to an end. When I step back and try to understand where the majority of sales growth has come from… I see this as the major driver.

Bulls will argue that Celsius will offset this with even more international growth, but the reality is that Celsius has been trying and failing to enter international markets for a long time now. Until I see success here, I have a hard time believing it.

We signed a deal last year with Pepsi that came in as an 8.5% owner within Celsius. We transitioned the distribution over them, October 1, 2022. We were sitting at about a 65% ACV, which means we’re in about 65% of the tracked retail locations nationally when we commence that transition. Quickly, rapidly, we jumped to about a 90% ACV by the end of the year, and now we’re situated around 95%, which is close to full distribution at this point.

Toby David – Celsius Executive

Questionable Leadership

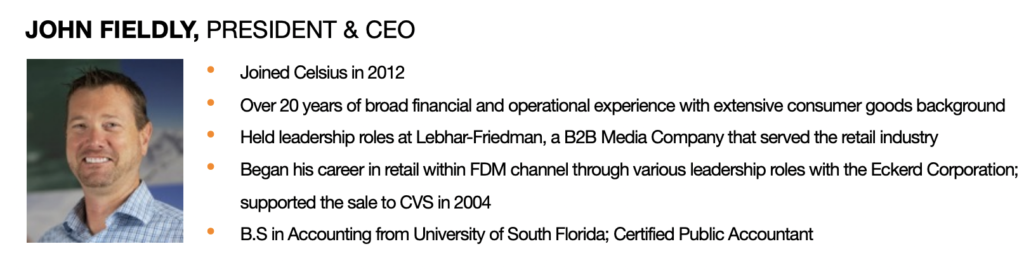

Another key thing to research is the leadership and board. A quick dive into the board left me underwhelmed but ultimately didn’t yield any major red flags. The management team does lead to some more interesting results with John Fieldy (President & CEO) coming from biotech company Oragen, where he was controller. Oragen’s historical stock results speak for themselves. Fieldly left Oragen to become Celsius’ CFO.

When the CEO comes from biotech… it starts to explain what is happening here from a marketing perspective. Yet that is conveniently left out of this summary?

Mission Statement

Now I’m just being a bully, but come on, this is their mission statement? This is a $10B company?

“become the global leader of a branded portfolio that is proprietary, clinically proven, or patented in its field”

Celsius Mission Statement

Material Weaknesses

Celsius has had a series of accounting problems which were mentioned in their most recent annual report. Below is a high-level summary of the problems prepared by my assistant chatGPT.

- Evaluation of Disclosure Controls and Procedures: The company’s President and Chief Financial Officer concluded that the disclosure controls and procedures were not effective due to material weaknesses in internal control over financial reporting.

- Material Weaknesses in Internal Control Over Financial Reporting: The document lists two main material weaknesses:

- Ineffective design of information technology general controls (ITGCs), particularly regarding the segregation of duties over program change management for certain applications.

- Failure to design and implement components of the COSO Framework to address all relevant risks of material misstatement, including elements of control environment, information and communication, control activities, and monitoring activities components.

- Management’s Remediation Plan: The company has outlined a plan to address and remediate the identified control deficiencies, which includes improving change management consistency, enhancing the control environment, and implementing more effective review and oversight responsibilities.

- Audit Opinion on Internal Control Over Financial Reporting: The independent auditor, Ernst & Young LLP, expressed an opinion that, due to the material weaknesses described, the company did not maintain effective internal control over financial reporting as of December 31, 2022.

It does help that Celsius upgraded from a sketchy auditor to E&Y. Yet, E&Y has revealed several material weaknesses that have yet to be resolved. This is not a great sign given their questionable past. I’d have serious questions if anything has changed.

Follow the Money

It doesn’t help that the largest investor in Celsius was Carl Desantis (RIP). He was known for a multivitamin company Rexall Sundown which ended up being sued by the FTC for deceptive claims… It’s almost like they have a playbook. The heirs to his fortune appear to be aggressively selling their shares.

When you scan the top holders of Celsius stock… you find a lot of Hong Kong investment money here (I’m not familiar with these investors) and a passed-away investor with billions at stake (Desantis). This is not my area of expertise here, but if you go to Whale Wisdom and sort high to low, Celsius looks a lot different than other stocks. When you look at insider sales, you see a lot of insider selling. Overall not a great situation.

Bang Bang

It’s not the same, but I do see some similarities between Bang and Celsius. Bang made some false claims and ultimately lost a lawsuit for $293M causing them to hit bankruptcy.. and eventually get bought out by Monster. Furthermore… the massive rise in sales was driven by Pepsi replacing their Bang shelf space with Celsius. I think Celsius has far more staying potential than Bang did, but overall it’s hard not to see the potential.

The Bull Case

Why has Celsius been successful to this point? It’s a highly caffeinated beverage that tastes good and convinces people that it is healthy. People love caffeine, things that taste good, and lying to themselves that the prior two are healthy.

The easiest / laziest bull case going forward is international growth. That is a lot harder than it seems. I don’t have a ton of insights here, but I wouldn’t just assume this will happen quickly. It will likely take years to gain traction.

The other bull case for Celsius, and what should’ve been a sign of rising sales to come was Celsius’ success on Amazon. Most of the major energy drinks are on Amazon and Celsius sales have outsold them.

The other thing that is worth stating is that it takes excellent execution to hit this sales growth. Or maybe it doesn’t since Peloton did it. Either way, people have been doubting Celsius for years now and they’ve all been buried. I saw what they all were saying and agreed on the downsides for the past few years. The life of a bear is terrible.

Wrap It Up

The simplest way to explain Celsius is that is a highly caffeinated drink that tastes good and has a strong brand. I’m making it a lot more complicated than that, which I think is needed to provide an accurate picture of all the shady shit Celsius is doing. I’d short Celsius, but I need a catalyst and I don’t see it right now. I think the bear case is a shady company, with the major catalyst of increased distribution wrapping up (currently at 95%).

Blindly shorting a drugged-up cult without any downward pressure is probably a bad idea, but when that catalyst hits, I’ll be buying puts like a madman.