The Problem with Netflix

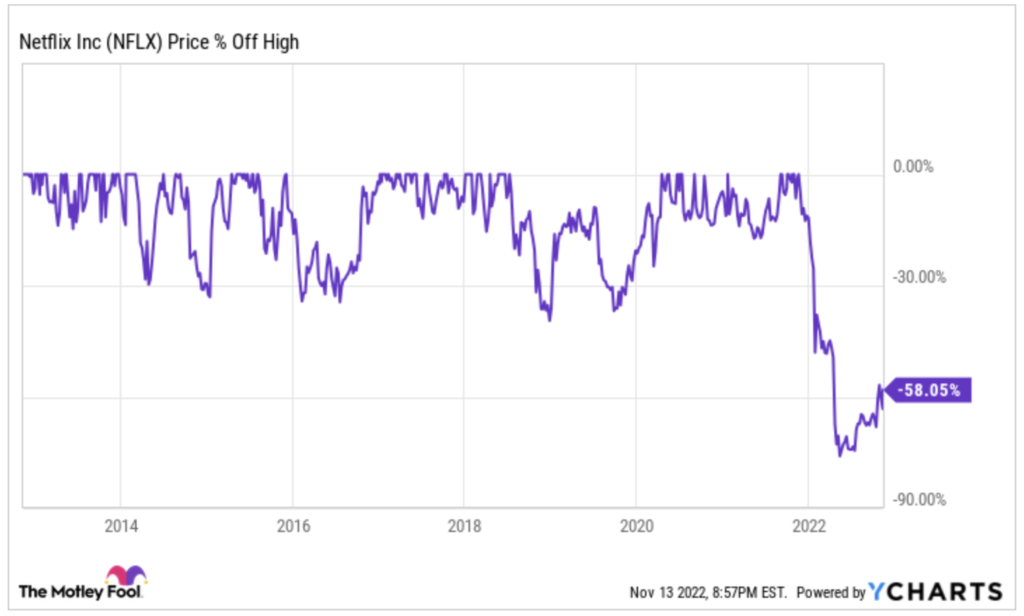

Netflix had been consistently out performing for 10 years.. then fell off a cliff. Is this a buying opportunity? Let’s dive in.

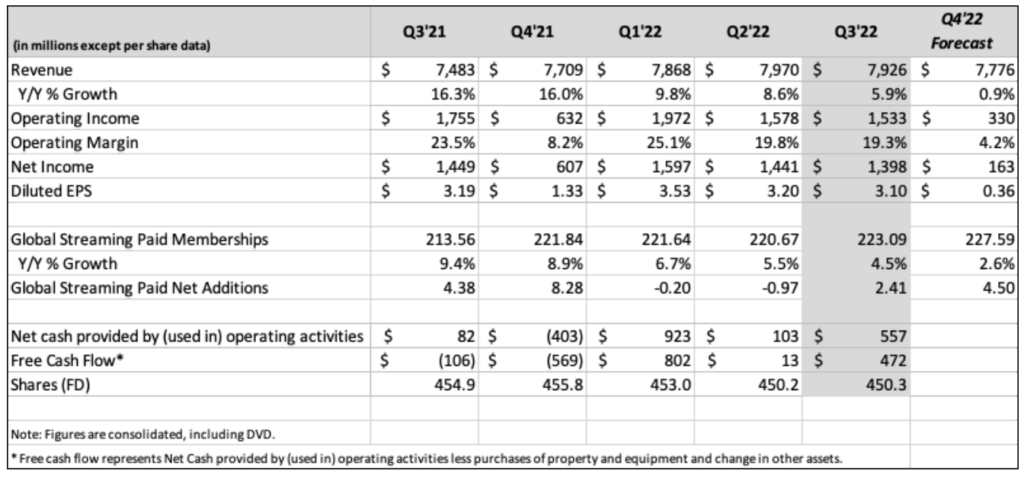

Netflix had been on a tear. They created their own category, then continued to dominate it for a decade while competition dragged their feet. They massively grew users, raised some prices and significantly grew revenue.

The Problem

The problem with Netflix is they only have one source of revenue. They make money from the subscription and that is it. You can only grow your users for so long and raise prices so much.

Users & Password Sharing

Tracking users for Netflix is simultaneously simple and complicated. It’s simple because Netflix reports users… and complicated because a ton of those users share passwords. For instance UCAN (US/Canada) has ~75M users at its peak, with roughly 150 million households. Netflix is already at 50% penetration before you ever start to think about shared passwords. Rough estimates are UCAN shared passwords account for 30M more households (so roughly 75% penetration rate). Netflix owns the market! Other geographies do allow for a little more growth, but overall I wouldn’t expect significant user growth for Netflix, even if they crack down on password sharing. So if growth isn’t coming from users… will it come from pricing?

Pricing

Netflix pricing is already pretty steep at $16.37 per user, but churn is still extremely healthy for Netflix (albeit rising). I think given the rising churn, increased competition and recently increased pricing, Netflix is starting to find where their price elasticity starts to rise (i.e where churn rises significantly due to price). This is just a guess on my part though… I don’t think any public data exists (beyond churn) that can help answer this question.

The Growth Problem

If you aren’t meaningfully growing users and increasing price causes you to lose users… where does your growth come from? Netflix is painting a picture of ads, gaming and password sharing crackdowns.

Enter Ads & Gaming

Ads can help reinvigorate user growth to a point, opening up their market to a lower price point. Furthermore, not only could it help users grow, monetization might be better on ads than straight subscription (Hulu makes more from ads than subscriptions). Ads are a logical way to allow further user growth… and even possibly increase profitability from the current model. I believe this will be a short term boost, with some longer term potential as well.

I’m a little more bearish on gaming. It’s a fundamentally different industry. What is Netflix’s advantage here? I don’t really get it, but if you keep costs low, it’s probably worth the experiment. The problem is costs rarely stay low (they are now at 5 in house gaming studios). Netflix has had some publicity here, but recent reports have shown less than 1% of users have tried gaming. It is still early in gaming, but I don’t see it right now.

Is That Enough?

To me, no. Ads are nice, gaming seems like a bust. What is the long term vision? It looks very similar to the current company, which isn’t enough.

My preferred form of new monetization for Netflix would come from leveraging their capex spend into IP, then eventually licensing this out. Disney has laid out the case for this. In fact, Disney has tried the gaming path that Netflix is on right now… and has failed many times. Eventually, Disney returns to licensing out their content. Eventually I think this is what will happen with Netflix, but to be frank, their content isn’t good enough right now for this. The problem with Netflix is twofold: they lack optionality and their past growth avenues are closing.

I’ll closely watch what happens with Netflix, but until they meaningfully unlock a new area to monetize, I think they are stuck in financial purgatory.

P.S.

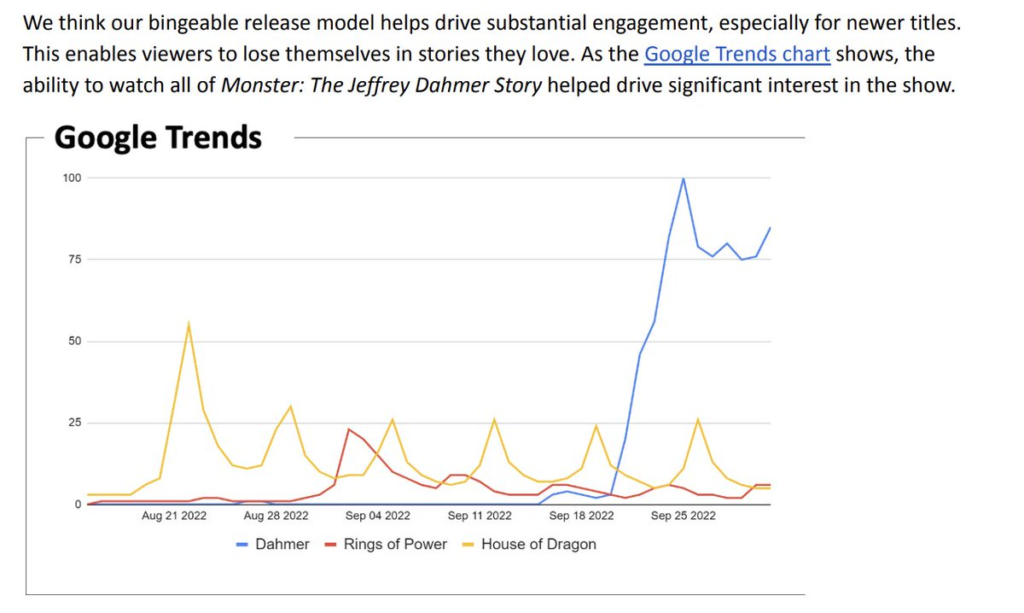

Please don’t use google search history like it is an engagement metric. It’s bad enough when twitter does it, now major corporations are doing it. Pls stop.

P.P.S.

“You get a show or a movie you’re really dying to watch, and you end up staying up late at night, so we actually compete with sleep. And we’re winning!”

Reed Hastings

That quote drives me nuts. A. people sleeping is good for them… you are actively wishing your customers into bad health. B. you’ve underperformed the market since this quote… and it’s not because sleep won. If you delude yourself, you’ll likely make poor decisions. Have a good night of sleep!