The Parable of Growth

Growth is the holy grail for businesses. In the moment, every business chases potential for growth. Not being ready to accommodate the growth is never acceptable. However, chasing growth too far can put you into a world of hurt. Businesses need to balance chasing growth with not getting over extended.

Here are a few businesses that have fallen for the parable of growth:

- Peloton

- Target

- Shopify

- Almost every tech company ever

You might think I’m joking by saying every tech company ever, but look at Google’s hiring history. These companies sit fat. Part of it is to chase elusive growth, part of it is to cover up just about how much money they make. I recently talked with a tech employee in San Francisco who explained why these companies run so fat. When you are consistently growing your revenue, you need to be consistently growing your headcount. Hiring, onboarding, training, etc… is a huge effort that takes 6 months plus before employees are productive. If you wait until you see the growth to expand your headcount, you are at least 6 months behind. So instead of being 6 months behind, these companies decide to be 6 months ahead.

Beyond Just Tech

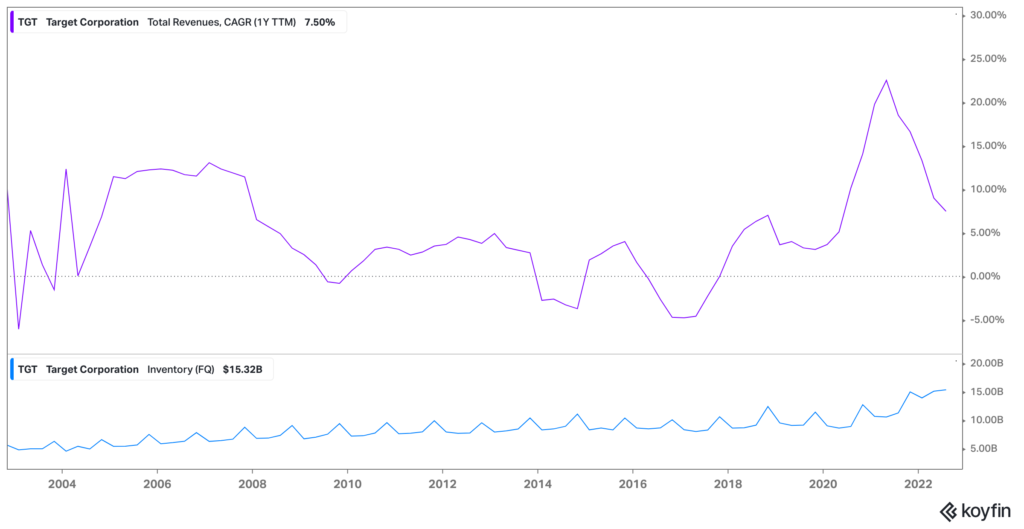

Target is an outlier on the list above, but every company is liable to these problems. In many ways, non-tech companies have an even harder time dealing with growth. An easy example to explain some of the problems Target is having is around their inventory. As sales rise, you need to stock more inventory. When the supply chain struggles to keep up with the increased levels, you raise your stocking levels even higher to account for longer lead times (aka you stock even more). Then it comes all crashing down when the growth reverses. This is what Target is dealing with right now. The problem for Target is even steeper though… it goes far beyond inventory. This applies to headcount, capital expenses, and many more categories as well.

When the Tides Change

The problem comes when the tides change, causing growth to greatly decelerate. All of a sudden you thought you were 6 months ahead on headcount, but now are 18 months ahead, creating a double effect on the P&L with revenue slowing and operating expenses accelerating (a bad combination)!

I really don’t judge companies that get caught over extended a little bit. Opportunities for growth are limited and need to be taken advantage of. Some companies take growth way too far and significantly over invest (see Peloton). When the tides do change, you need to aggressively make changes. How you recover from your mistakes is the most important part.