Great to Good: Why Good Companies Can Be Bad Investments

Buy quality and hold. It sounds so simple and true. Unfortunately, buying good companies at the wrong price can be a terribly painful way to invest.

Worse yet, great companies can deteriorate into good companies. Let’s dive into some examples.

Microsoft

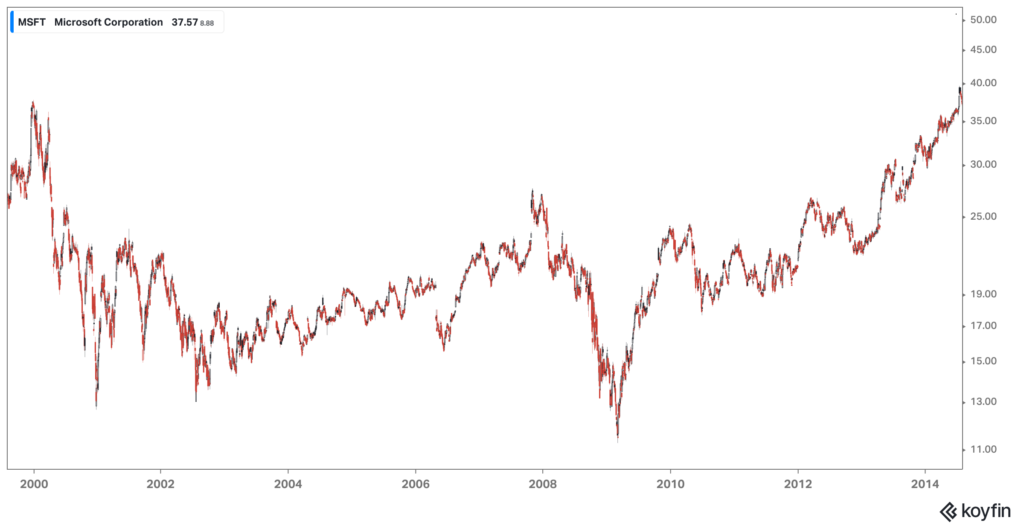

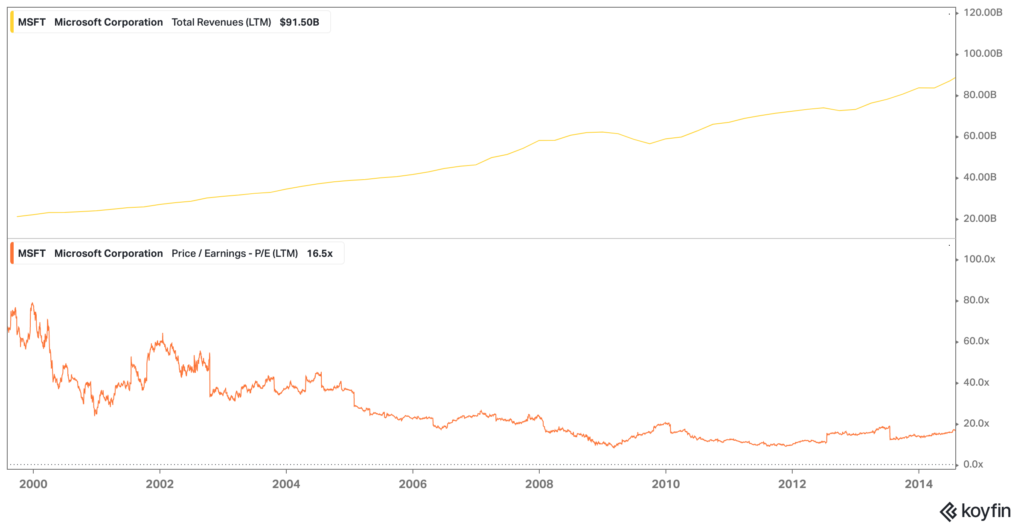

Nowadays everyone thinks of Microsoft as a prototypical great company, but from 2000 to 2014 Microsoft traded flat.

It’s easy to create a narrative around why this happened, but the reality is that Microsoft did grow at a decent rate for a long time. The problem is they just didn’t grow fast enough to cover their valuation.

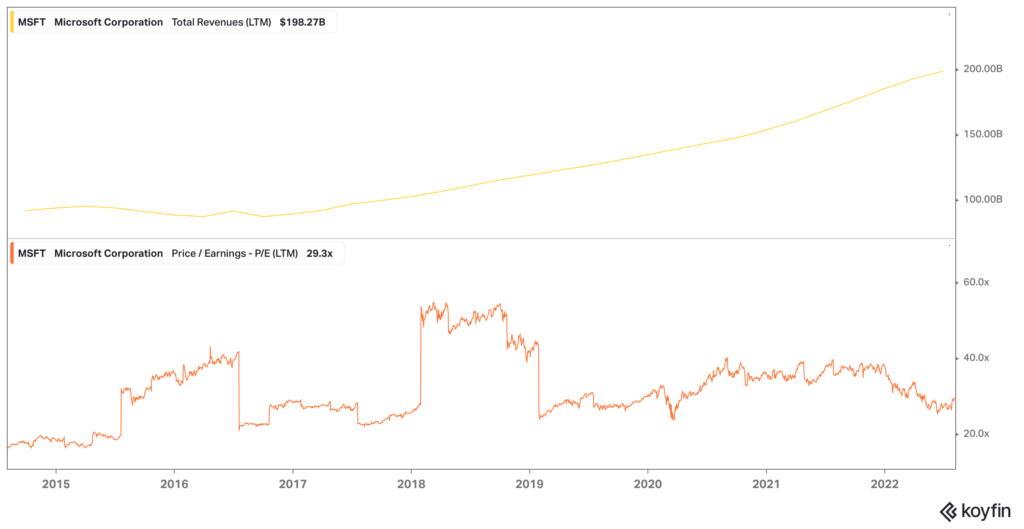

Since 2014, Microsoft has transformed back from a good company to a great one under Satya Nadella. Companies aren’t static things, they are dynamic. Most follow more linear trends, but some oscillate as the business evolves or devolves.

Cisco

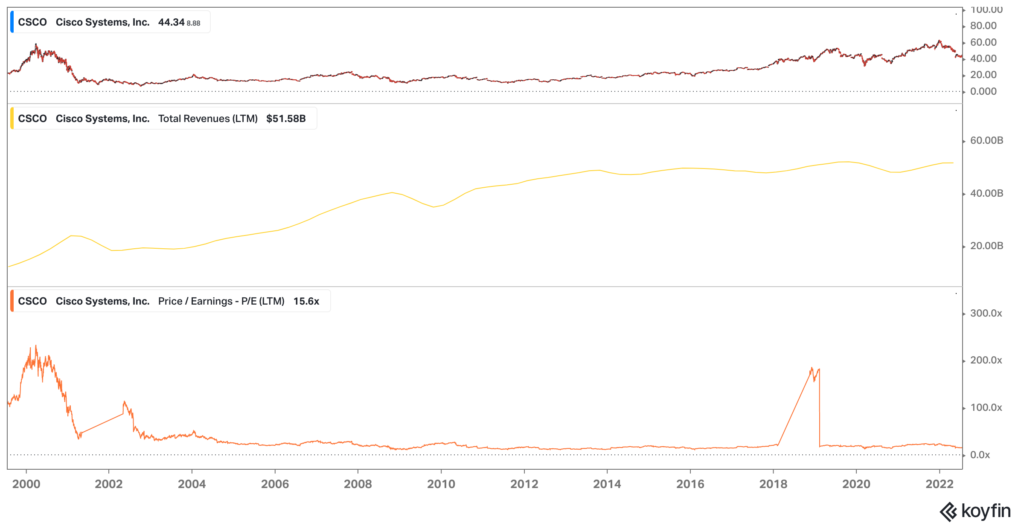

Microsoft was a painful investment for 15 years, but Cisco has been a painful investment for 23 years. Everyone thought they were a great company, but in reality they were an okay company.

Whose Next?

A lot of companies could fall into this list. The hardest part is that all of this is relative to price. A stock trading at 30x sales has a much higher climb (and expectations) than one trading at 3x sales. Whether it’s Shopify or Facebook or Apple, just because a company has a great past, doesn’t mean they’ll have a great future.

What do you do?

I think it’s important to be patient in determining whether a company is good or great. The goal is to buy great companies at good prices, but it turns out buying good companies at any price is a painstaking process. My main takeaway is to be patient not only with what you buy, but also when you buy it.