Zillow: Experiments Gone Wrong

Recently I wrote about Zillow’s tough decision to enter iBuying and how Zillow was trying to disrupt themselves. Then shit hit the fan.

What Went Wrong

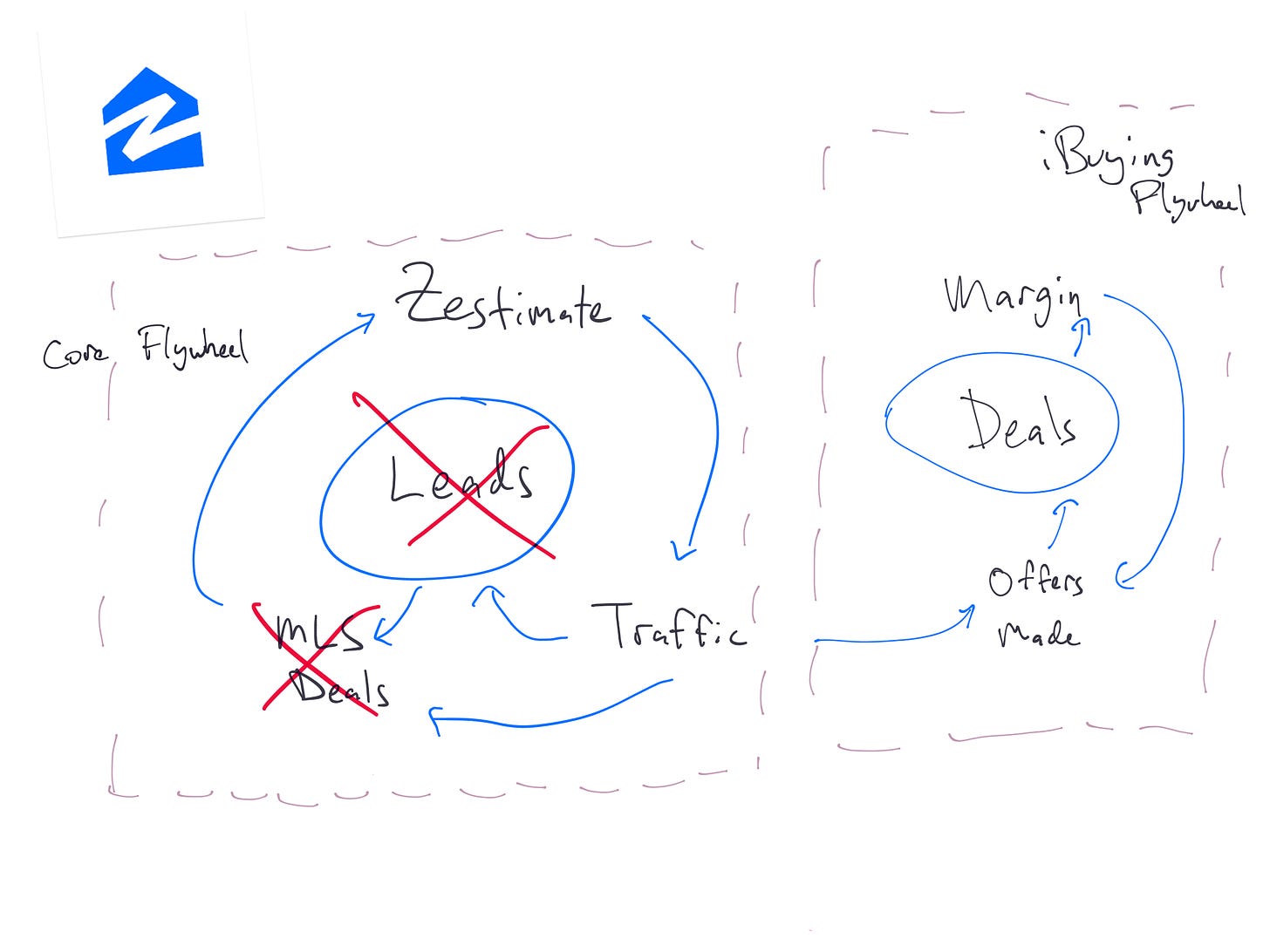

A tech company entered a capital-intensive business. Why would they do that? They were following their north star… the customer. iBuying has a lot of great promises for customers and Zillow saw a flywheel that worked with their current business. Zillow saw a threat and quickly acted against it.

To me, Zillow went too far, too fast with iBuying. I think entering iBuying was the right move, but does entering this fast make sense? Zillow was always in a tough spot when comparing Zestimates to iBuying. I think Redfin is doing iBuying right.

Where I Went Wrong

First of all – I bought Zillow ahead of earnings. That was dumb. Very quick way to lose $200 (I think I’ll make that back over time…. the beauty of buy and hold).

Zillow tried to disrupt itself, then concluded that the model of disruption wasn’t the future. Maybe they are wrong, maybe iBuying is the future, but I have a core belief that forecasting is harder than most realize and Zillow was attempting to forecast housing prices. They failed. I trusted Zillow even though I don’t trust forecasting.

I always struggled with iBuying (and still do). It seemed like a bad idea, but a lot of great ideas seem like bad ideas. I think iBuying is a part of the future, but it will take a great company, with high fees to do it. Customers will get great ease but pay a stiff price. Zillow won’t be this company.

What Went Right

I wrote this piece because I admired the move to take the risk of entering iBuying. I still think that was the right decision (but the execution was clearly lacking).

Zillow took a big swing and whiffed hard, but based on this commentary, exiting was the right thing. Zillow felt they were in an non-ergodic state and that is a bad place to be (a.k.a the whole company was under threat).

“Put simply, our observed error rate has been far more volatile than we ever expected possible and makes us look far more like a leveraged housing trader than the market maker we set out to be. We could blame this outsized volatility on exogenous black swan events, tweak our models based on what we’ve learned and press on. But based on our experience to-date, it would be naïve to assume unpredictable price forecasting and disruption events will not happen in the future.”

Rich Barton on Q3 Earnings

Pulling the plug on these kinds of decisions is hard. Your stock loses 30% of its value in a week and you need to lay off 25% of your workforce, but just like making the decision to disrupt yourself is difficult, admitting you are wrong is difficult.

Capital Punishment

My biggest concern is that this whiff will scar Zillow and prevent them from trying to disrupt themselves in the future. Right now, I think Zillow decided capital-intensive businesses aren’t for them. With iBuying likely to remain a low percentage of overall transactions, I think avoiding capital intensive businesses isn’t super limiting for Zillow, but it is something to keep in mind long term.

“Lastly, we believe this is an opportunity to refocus and more broadly address a wider audience of customers with more asset-light solutions.”

Rich Barton

P.S – Even if iBuying remains a small percent of the overall market, that is still a huge TAM. OpenDoor remains a very interesting (albeit dangerous) company.