Roku: The Next Great Operating System?

Some of my favorite stocks are found out of confusion. I have assumptions in my head, that slowly start to reveal themselves as not true. When I first thought about Roku as an investment opportunity, I dismissed it. Just another hardware company trying to sell themselves as something else. But my ignorance quickly showed. I’m trying to attack Roku in a different and brief way, but if you need a deeper dive into Roku, check HERE and HERE.

A Quick History

Anthony Wood founded ReplayTV, one of the first DVR companies, in 1997. In 2001 ReplayTV was sold and subsequently Roku was founded. Anthony Wood briefly served as a VP at Netflix, until the company decided not to develop its own player. Roku was then spun off, but received financial backing from Netflix.

Roku quickly began gaining market share with its variety of streaming boxes. Eventually the streaming box became embedded into the TV, making a smart TV. Then Roku’s future as a company changed once they rolled out their platform business. The platform business is driven by their ad network.

Operating System of the TV

The hardware for Roku is a trojan horse. Roku makes no money here and never will. But when you control the video streaming ecosystem, you control the power. Much like Apple has enormous power with the app store, Roku has power over streaming companies. Companies like Disney need to negotiate with Roku to get their app into Roku. Given the massive userbase, streaming companies need to be on Roku. The cost of missing out is too high for streaming companies.

Yet for the best user experience, Roku needs to have all the streaming companies available as well. No customer wants to miss the hot new series because Roku is negotiating for the best deal. I think Roku can and has navigated that scenario.

Dumb Questions without Answers

Below are some questions I thought about on Roku. I didn’t answer them directly here, but they all fed into the rest of the blog.

- What if the TV is no longer the distribution channel?

- Is Roku a middle man?

- Will Roku face regulation?

- Does aggregation theory apply to Roku?

- Can blockchain replace Roku?

- Is Roku really an operating system?

- How much value does Roku create?

- Who are the major customers called out in the financials?

- Who will Roku’s biggest competitor be in the future?

- Apple charges 30% in the app store, how much can Roku charge?

- How much leverage does Roku have over streaming companies?

- How strong are the tailwinds (shift from linear TV)?

- What are the long term expectations of margins?

Sticking Points with Roku

When I look at Roku from a consumer angle, I’m not super impressed. Don’t get me wrong, Roku is nice. It is a smooth experience. But I have a Fire TV and it works great too. I don’t see the differentiation. If the bull case for Roku is the massive and growing industry, you’ll need to add value. Historically, Roku did that. But expectations have risen. Competition will come. A clean OS at a cheap price isn’t enough when you are making massive profits on the platform. Someone will come along and give away more (TV, movies, gaming, less ads, etc…) for less. Roku needs to differentiate now to get ahead! Compete with yourself so you don’t need to compete with the competition.

It’s always easy to say, “just add more value”. But it is a tough thing to do. I think they are on the right track with the Roku channel. I’ve always loved the freemium model and that might just be the key to Roku unlocking value. Yet, Roku channel is available on Fire TV, so is it really a differentiator?

I don’t see a clear answer to why users will continue to choose Roku other than:

- It is what they are used to

- They have no choice

I don’t like either of those answers, because I want to own companies who dominate the market. Companies who add so much value, you are dumb not to buy from them. Unfortunately that isn’t Roku. A clean OS isn’t enough.

Roku has an amazing value proposition to everyone but the user (advertisers, 3rd party apps, etc..). The value prop to the user is just okay.

The Battle for the TV Heats Up

I think Roku is strategically placed to dominate a huge market. But given the huge market, the tech behemoths (Apple, Google, Amazon and Microsoft) have been relatively quiet. Don’t get me wrong, they’ve all been competing but in their own weird way. This is one of the many ways that Roku reminds me of Spotify.

- Amazon – The biggest competition for Roku, but Amazon is (understandably) focused on Prime. The value proposition of Prime is insanely good, but it isn’t for everyone.

- Apple – Too expensive, not an ad company and iPhone moat doesn’t really help here. Not being natively built into TVs is a disadvantage.

- Google – An interesting player in this area. If it becomes clear this is a massive opportunity, Google has a ton to offer. Chromecast isn’t bad, I just don’t think it is good. Google has a ton to offer in this space… if they want to.

- Microsoft – The sleeping giant.

- Everyone else – The TV manufacturers don’t really stand a chance here. They just can’t keep up and provide a meh experience. Could Netflix or Disney enter the market? Would it even matter?

Everyone is starting to realize the size of the prize, so serious competition will come at some point. Also… not that I think it happens, but Facebook is dominating virtual reality. Virtual reality seems like the best bet to disrupt the TV.

Other Random Notes

- The platform segment has $1.5B TTM sales and growing 101% YoY. Rough numbers that means Customer H is contributing ~$200M in recurring revenue. I don’t have any great guesses who this customer is, but maybe Disney? Customer A, B and C are Amazon, Best Buy and Walmart. It is crazy that Amazon is the largest competitor, yet one of the largest suppliers of their players.

2. Share dilution sucks. I get why you dilute, but this is a rough view no matter what. Dilution is not free money.

3. It’s shockingly hard to research Roku. The platform revenue is a blackhole without much information behind it.

4. The Roku Channel has massive potential. I don’t think it will ever reach it, but if I look hard enough, I see it. Related – the Roku Channel has about half the ads of conventional TV. The customer experience always wins.

Final Thoughts

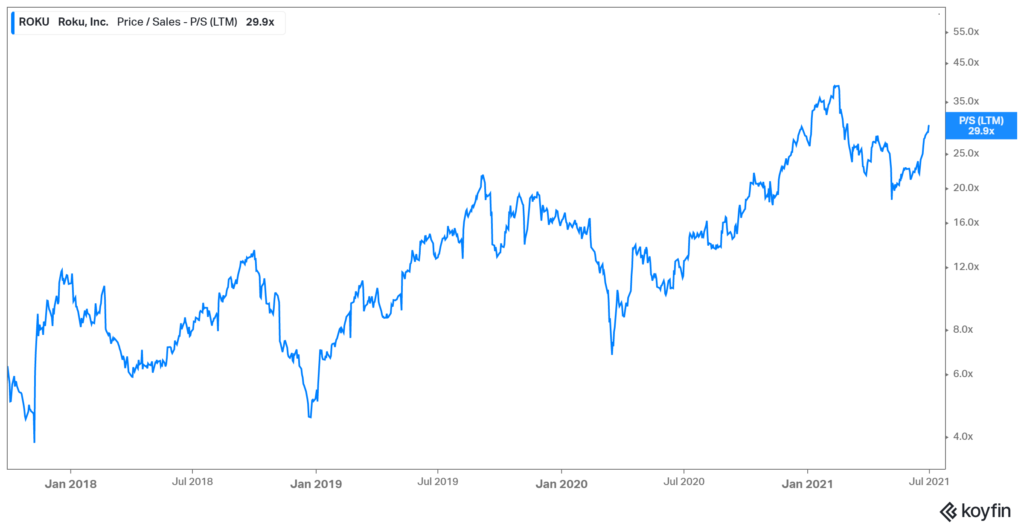

I’m not buying Roku. Right now, I only see a good company at a bad price. I just can’t get over this chart, because holy multiple expansion! Roku doesn’t have a strong brand, it’s just a cheap, omni present player that is very strategically placed. I have a tough time paying 30x sales for a company that doesn’t have pricing power.

Roku is a good company, possibly great. If Roku were cheaper, I’d buy it. Making buy or sell decisions based on valuation has bitten me in the past, but I just can’t ignore the valuation. To pay 30x sales, I need to see perfect execution and a clear future. I don’t 100% see either with Roku. If Roku emerges as a great company (more optionality, stronger brand, more pricing power, etc…), I’ll be willing to pay up. It might come at a higher price, but that is a risk I am willing to take.