Inflation: I’m Interested

I’m a little nuts. I read too much zerohedge, then get a little nervous. I’m already anti-government to begin with, so sometimes I can get a little angsty. Today my angst revolves around inflation.

But, a lot of smart people are concerned. Inflation is top of mind for everyone from Stanley Druckenmiller to Michael Burry to Warren Buffett. Let’s dive into what each of these legends are saying.

The Data

Before we get into these individuals concerns, let’s talk high level on inflation. Two things drive inflation:

- The supply of money

- The velocity of money

Let’s start first with the supply of money as it is easier to understand/see the problem. The government is printing money like crazy. It made sense during the height of COVID, but we’ve essentially finished the V-shaped recovery. Our economy is relatively normal, but we are still printing like crazy. In the next year or two, our monetary supply will have tripled since 2010. This isn’t normal.

The velocity of money complicates things. Think of velocity of money as how fast money exchanges hands. If you never spend the cash you have, the prices of things won’t rise (i.e. the demand for the goods hasn’t increased). The velocity of money has been slowing over the last 10 years, which led to limited inflation, despite a significant increase in our money supply. Essentially, despite printing huge amounts of cash over the last ten years, we haven’t had massive inflation due to a reduction in the velocity. Inflation was increasing slower than our money supply was. But will this continue? I have no clue. It’s even tough to tell why velocity slowed in the first part. Some of the explanations I’ve seen have been around increasing inequality, et cetera. But you can already see a decrease lately in the velocity of money from the uncertainty surrounding COVID. In addition, you can also see significant increases in the cost of commodities like steel, lumber, etc… Inflation is extremely complicated, but the data doesn’t look great to me (let’s be honest though, I only 50% understand this stuff). Simple logic and real life commodity pricing don’t look great in any case. But let’s see what some people much smarter than me think.

Stanley Druckenmiller – a.k.a the Macro God

Stanley Druckenmiller is a legend. In 30 years managing Duquesne Capital, Stanley averaged a 30% return and had no calendar years with losses. That is absurd. Much of that success was driven by his understanding of macroeconomics. So when Druckenmiller talks macro, I listen. Inflation terrifies Druckenmiller. He refers to inflation as the biggest threat to the equity market. The smartest macro investor in the world is terrified of inflation, so I am as well.

“The problem was Jay Powell and the world’s central bankers going nuts and making fiat money even more questionable than it already has been”

Stanley Druckenmiller

While Druckenmiller has an incredible track record, he has been warning against inflation since 2013. Why is this time different?

Michael Burry – a.k.a the Big Short

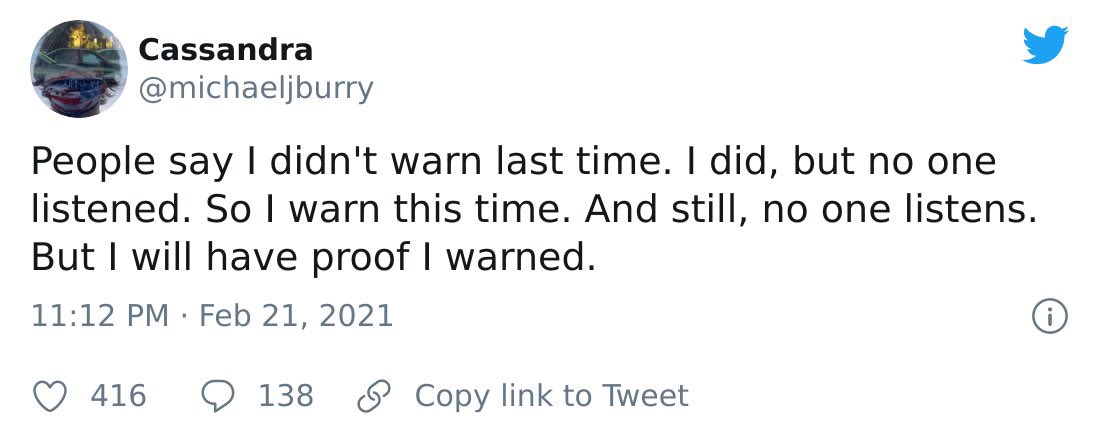

Michael Burry gained fame from the movie The Big Short. Based on a true story, Burry identified vulnerabilities in the housing market ahead of everyone else, but no one would listen. Burry went onto make massive profits off of shorting the banks. He made a fortune off of that short and has numerous other big bets as well.

Now Burry has made some big bets on massive inflation coming. He recently made several (since deleted) tweets around inflation. Burry did not hold back and made references to Weismar hyperinflation (post WW1-era insanely high inflation). When combining his tweet storms in addition to his massive bets on inflation, Burry’s feelings are clear.

But much like Druckenmiller, Burry has his share of misses in the past. Is he right this time?

Warren Buffett – a.k.a the Oracle of Omaha

Druckenmiller and Burry are without a doubt great investors, but they aren’t Buffett. No one is Buffett. So when Buffett speaks, people listen. And like everyone else, Buffett is speaking on inflation.

“We are seeing very substantial inflation. We are raising prices. People are raising prices to us and it’s being accepted.”

Warren Buffett

But unlike Druckenmiller and Burry, Warren isn’t making huge bets on this inflation he is seeing. Warren is less worried about how to handle inflation. He just buys great companies and lets time compound. In the grand scheme of things, inflation isn’t a big deal to Warren.

So You Are a Nervous Nelly?

Most people are already properly hedged against inflation with significant debt and high percentages of their wealth tied up in real estate. Both are natural hedges against inflation. But for better or worse, I have no debt and no real estate. On top of that, I have significant piles of money in cash and a significant portion of my wealth in growth stocks.

My first hedge against inflation is Bitcoin. I believe long term Bitcoin will benefit from becoming a reserve asset and inflation will help drive a gain in trust over time. But that is in the long term and Bitcoin is still a highly speculative asset. With so many YOLOing, a massive change in the market might cause extreme short term volatility for Bitcoin. But long term I think it could help.

My second hedge against inflation is going to be moving my money from cash accounts into TIPS (Treasury Inflation Protected Securities). I personally keep a lot of money in cash accounts, but not anymore. I’ve reviewed other options (commodities, etc…) but TIPS seem like the best option.

My third hedge against inflation is going to be YOLO call options on leveraged inverse bond funds. This is dangerous. But this is fun. If inflation is happening, I think it is here now and the bond market will reflect it quickly. To me, this is the perfect opportunity for options. Worst case, I lose this small amount of money.

My fourth hedge against inflation is owning great businesses with a long time horizon. Over time, great businesses thrive, no matter what the market conditions are. I expect extreme volatility if inflation does come and stay, but ideally I can flip YOLO options money into more shares of great companies. Inflation would also hit my portfolio harder due to being heavy growth.

I’m Interested

Overall, I’m concerned, but not freaking out. I’m giving myself low risk, high upside options that can help mitigate the risk of inflation. I won’t sell any of my investments (due to inflation), but I do expect significant volatility. I’m more in the Warren Buffett camp of just letting great companies compound, but I see an opportunity for asymmetric risk/return. My guess is that the market will temporarily overreact to any interest rate change. Interest rates are clearly important to valuations, but we know they need to go up. Yet the market will freak when they do. And if inflation jumps, interest rates will need to rise. Investing is risk management and I believe this strategy can reduce my downside risk, while also allowing for upside.

In the short term, I’m a pessimist. In the long term, I’m an optimist.