Sea the Future

Sea Limited is swimming in optionality—a three headed monster that is evolving. Growing three businesses remarkably fast, while still investing in other areas. Can their rapid gains continue? Or will they drown in a sea of debt?

A Brief History

Sea is made up in three different subsegments: gaming (Garena), e-commerce (Shopee) and financial services (SeaMoney). It was founded in 2009 (originally just Garena) by Forrest Li. As a company, Garena quickly evolved from a gaming distribution platform to developing their own game (Free Fire) and expanding into e-commerce and financial services. Sea’s mission statement is “to better the lives of consumers and small businesses with technology.”

In a time of great digitization, Sea is perfectly positioned to take full advantage.

Garena

It all started with Garena, a digital entertainment business. Garena is a global game developer and publisher. Initially they just distributed others’ games until they developed Free Fire, which quickly turned out to be a huge hit. Years later, Free Fire is only gaining steam and entering new markets. Driven by the freemium model, revenue is primarily driven from in-game purchases. Garena has many social aspects as well, with the livestreaming of online play, user chats, and online forums.

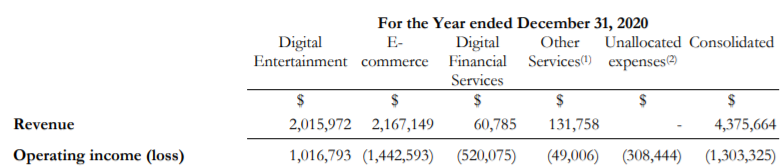

It all comes back to Garena too. They are the cash cow (~$2B in free cash flow) that allows for significant reinvestment. In theory Garena is AWS for Amazon. It’s a nice distribution business, but an amazing publishing business. Sea is taking all kinds of steps to make sure they are ahead of the curve, but gaming is a dynamic industry.

Garena is a microcosm for what Sea is. Constantly evolving, but filled with risk. Garena does come with concerns. So much of their success is driven by Free Fire, what happens when Free Fire loses popularity? With only one successfully published game, how confident are we that they will create another big game?

Shopee

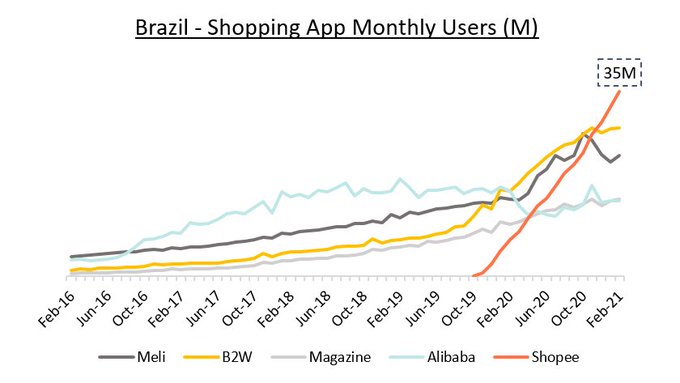

Introduced in 2015 in southeast Asia, Shopee quickly began to dominate the market despite stiff competition. Lazada (Alibaba backed) had previously dominated the region. Shopee was rolled out initially in Indonesia, Taiwan, Vietnam, Thailand, the Philippines, Malaysia and Singapore in June and early July 2015. More recently, Shopee entered Brazil in the fourth quarter of 2019, and Mexico in the first quarter of 2021. Shopee has been dominating every market they’ve entered.

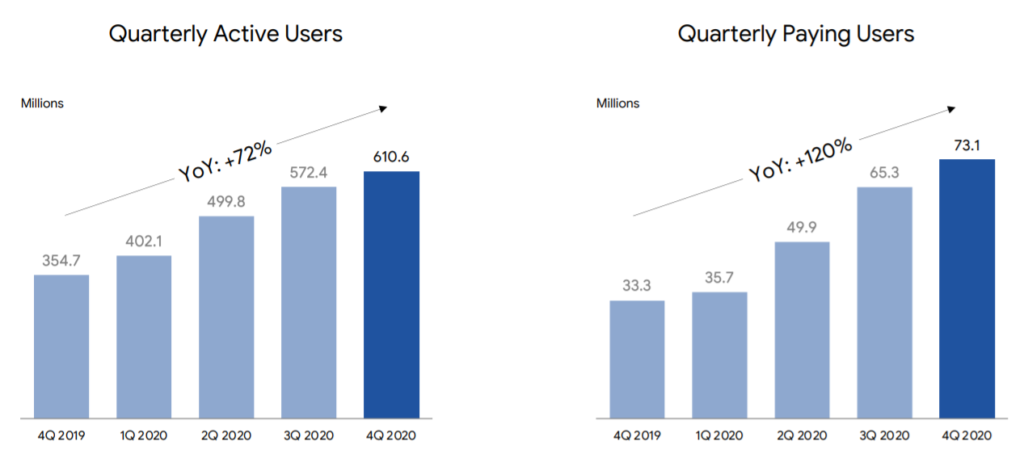

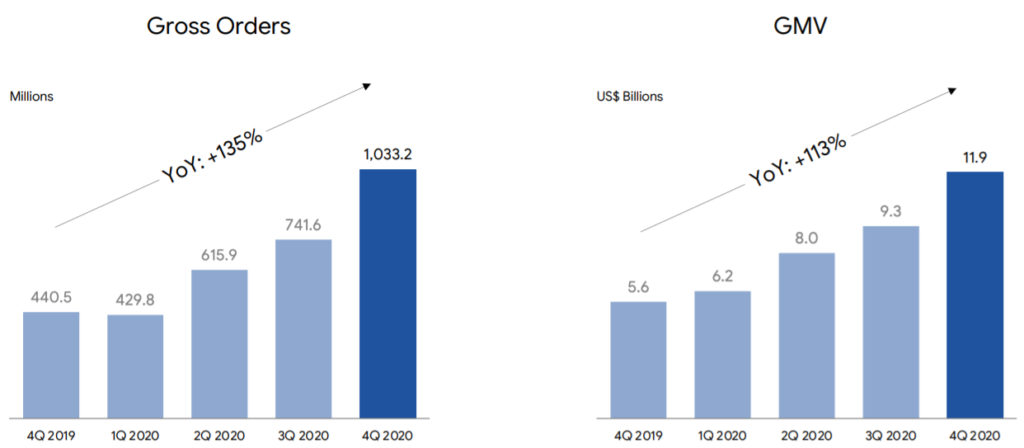

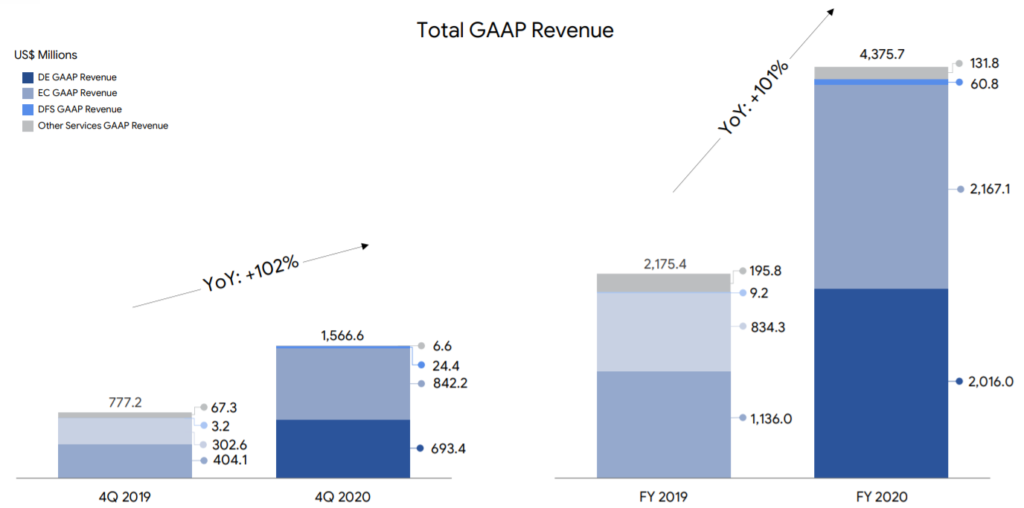

But holy shit do they burn cash. Sea primarily focused on lower value items to sell, and they also have been offering significant discounts. On top of that, they are paying for major marketing. From Ronaldo to other ads, Shopee spends significantly to gain new users, all while continuing to discount sales heavily. The growth is real with $2.2 billion in sales, up 159.8% year-on-year.

*Note: Deferred revenue for DE is driven by accounting practices related to timing

Orders, gross merchandise value (GMV), etc… are all growing like crazy. Unit economics are a concern, but I don’t think they are inherently broken. If you can afford to grow as fast as Sea is, you should. The question is how long you can afford to finance this kind of inorganic growth.

Financial Services

SeaMoney (aka DFS) offers mobile wallets, payment processing, buy-now-pay-later, and other financial products. Southeast Asia is significantly underbanked and SeaMoney looks to help offset that. The ties between SeaMoney and Garena/Shopee are very close. In many ways Sea Limited depends on SeaMoney, which somehow feels just as critical, but tiny compared to the other segments.

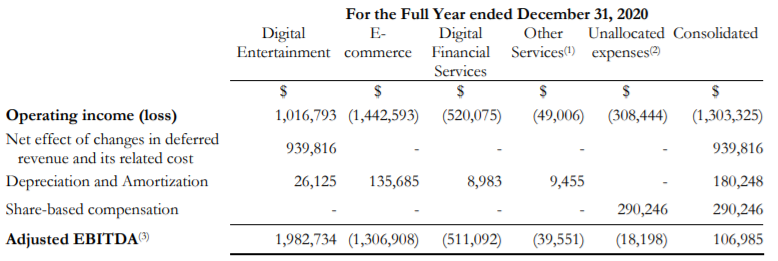

Speaking of burning cash, Digital Financial Services (DFS) had an operating income loss of ($520M) on $61M in revenue. Most of this cash burn is driven by sales and marketing ($438B in FY20). To be honest, I’m not sure how this money is being spent. Most of the ads I’ve seen while researching are Shopee-related, but maybe due to close nature of DFS to Shopee, some of that Ronaldo money is allocated to DFS.

Sea Capital and Future Optionality

Recently Sea Limited established Sea Capital to lead it’s investments. The initial allocation is $1B and is classic Sea, where they are not only reinvesting in themselves, but now others as well.

“Through Sea Capital, we intend to invest into and support the growth of our broader ecosystem to create value for our users, business partners, and communities. We believe the addition of the Composite team and the establishment of Sea Capital will further enhance our investment and capital allocation capabilities in support of Sea’s long-term growth strategies”

In conjunction with this announcement, Sea acquired Composite Capital Management and has tapped David Ma to lead Sea Capital. Many have compared this new entity to a Tencent type company. In reality it’s too early to tell, but given Sea’s impressive track record, I’m excited.

However, Sea Capital isn’t the only experiment that Sea is running. They also have quietly entered the food delivery business. What I love about Sea is that they aren’t afraid to invest in themselves and the future. Plus, due to the high profitability of Garena, that re-investment will come at a lower cash burn.

Sea clearly understands the social opportunities as well. From gaming to shopping to financial services, all of these segments have massive opportunity from a social perspective. An example of this would be “Shopee Feed” where users can scroll though an endless ecosytem of multimedia listings that they can comment on or like. In addition to the social aspects, Sea also is applying it’s understanding of the gaming industry to Shopee. A few examples of this would be “Shopee Games”, “Shopee Coins”, etc.. Combining the dopamine hits of gaming with the dopamine hits of e-commerce is powerful.

Swimming in a Sea of Numbers

Not everything is going swimmingly in the financials though. Adjustments are normal in financials and are commonly used to spin a different (not wrong, just different) story. But Sea Limited takes adjustments to the next level. Below is an example where operating income shows a loss of $1.3B to a gain of $100M. I’m not a fan of backing out share-based compensation (share dilution is a real expense), but the deferred revenue and it’s related costs are where the questions arise. GAAP (generally accepted account principles) require Garena to defer some of it’s gaming revenue over the expected life of the associated game. In general, this makes sense. Revenue should be recognized when it is earned. But Sea Limited is pulling all that revenue forward in their adjusted EBITDA. These kinds of massive adjustments cause a lot of confusion when reviewing financial documents and listening to earnings calls. Talking adjusted EBITDA and operating income is speaking two different accounting languages.

An example of the impact of these adjustments is below. While reading Sea reports, you’d see $2B in revenue for Garena, then also $2B in adjusted EBITDA. That means 100% EBITDA margins. Garena is profitable, but not that profitable. Sea Limited is speaking two different languages (GAAP vs non GAAP), mixing the two during presentations. It just gets crazy confusing. In reality, the $940M adjustment is additional revenue, meaning Garena only has 60% plus EBITDA margins.

Sea doesn’t come cheap. Trading at ~30x sales and ~$120B market cap. Is that too rich? Sum of parts valuation might help (i.e. break up the three headed monster into three separate monsters). Garena would be the highest valued. From a rough view, Garena is generating ~$2B in cashflow per year. At minimum, that’d be $60B. And this market isn’t pricing things at a minimum. $80B – $100B doesn’t seem crazy. So does $20B – $40B make sense for Shopee/DFS? I think so. Then you get the optionality for free.

All Sea-ing Eye

Owning Sea Limited is a little harder than other stocks. I can’t buy on Shopee (you can browse Shopee.com). It’s just tougher owning stocks you can’t use. Garena is gaining steam in the US, but still. What does the future hold for Sea? Right now, it is easy to reinvest while the Garena cash is flowing and the markets are pumping. What if Shopee has poor unit economics that lower profitability long term? How will Sea react if the markets tighten and Garena loses popularity? Is Sea’s optionality creating an antifragile company or a Garena-dependent company? Personally, I think they are trending towards antifragile but time will reveal the truth. Debt is fragile, optionality is antifragile. Which will win?

I’m long Sea Limited, but the risk is real. I can’t ignore this level of optionality, but it does come at a steep valuation. Sea seems like the future. Gaming, e-commerce and financial services, all driven by the internet. Booming industries loaded with dopamine from social aspects and gamification. I’ll keep my initial allocation low (less than 5% of my holdings), but I’ll let it grow.