Fat Fund Financials – P&Ls

Words are misleading. Play a game of telephone or try to recap an argument with your fiancée and you’ll quickly agree. Luckily in investing we have financials to help avoid having to play a game of telephone. Analyzing financials can seem tricky at first, but once you start to break it down it’s much simpler than most would imagine. My favorite financial statement is the P&L (or income statement). I love P&Ls so much that I review them for a living. I’m a P&L owner of every location that reports up to me. Every month I dive in and analyze 50+ locations. When you look at 600 P&Ls per year, you start to pick up a few tricks. NOTE: I work in industrial finance, not corporate finance. Nothing here will be fancy.

The first thing I look at when reviewing a P&L is sales growth. The fastest way to improve financials is through rapid revenue growth. Revenue is the biggest line on the P&L (hopefully) and provides the most leverage. So, try and understand what is driving revenue growth. Which part of the business is driving the growth (or lack of)? Is the growth driven by marketing costs? I also like to review financials both YoY (year over year – i.e. Sept. 2020 vs Sept. 2019) and QoQ (quarter over quarter – i.e. Sept. 2020 vs Jun. 2020). However, many businesses have seasonality that make QoQ reviews difficult. When analyzing revenue, unit economics are key to understand sustainability.

Margins are important because they essentially show how much money you keep. Gross Margins, EBITDA, EBIT, Net Income and Free Cash Flow are all important. They’re all different measures of how much money you are keeping. Margin % would just be Gross Margin, EBITDA, etc… divided by sales. You work hard to make revenue, and you should work hard to keep as much of it as possible. Low margins aren’t a death sentence. My favorite stock, Spotify, has low margins. What is important is understanding why they are low and what can be done about it. While revenue growth provides the most leverage into better financials, expanding margins is another key.

When possible, look to understand how businesses classify cost of sales versus operating expenses. Sometimes accounting can get complicated, but essentially the cost of sales are costs that are directly tied to production of the goods or services a company produces. Operating expenses are indirect expenses (think back office labor, etc…). When reviewing operating expenses, always keep an eye out for R&D. An R&D that is too low should be a red flag. R&D drives growth long term, but it is a quick easy place to cut costs. Low R&D can be a sign of shortsighted management. Operating expenses rising faster than sales growth is a red flag.

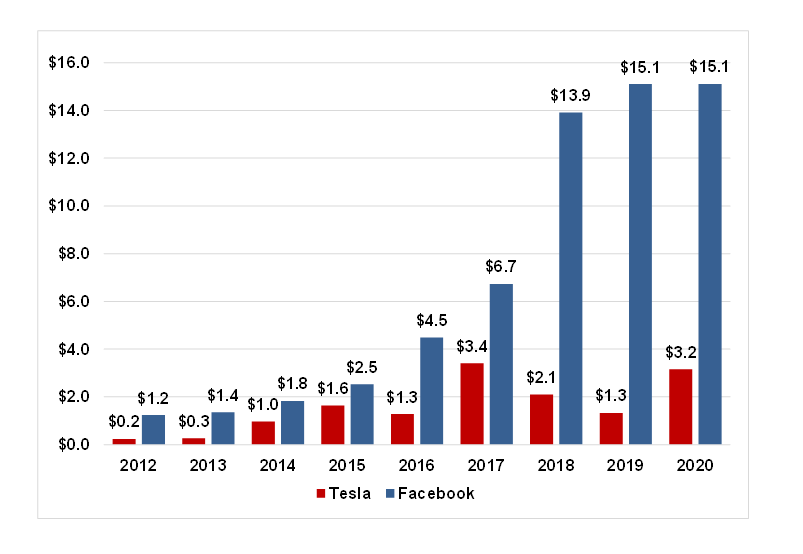

Understanding capital spend is also key. Capital spend is for investments a company makes that will benefit them for more than a year. Think buildings, vehicles, machinery, etc… Instead of recognizing this as an expense immediately, the benefit is depreciated across the life of the asset. Understanding the capital intensity of a business (how much capital a business uses to operate) is important. For instance, Spotify spends significantly less capital than other businesses. Interestingly enough, some businesses can surprise you with how much they spend on capital. For example, Facebook spends significantly more capital than Tesla. How is this possible with one being a car manufacturer and the other essentially an ad company? The answer comes down to data centers for Facebook, and Tesla being thrifty (or cheap). It is also important to note that Facebook has extremely high gross margins (main cost is capitalized), while Tesla has notoriously low gross margins. Capital spend is found on the cash flow, not the P&L. That being said, capital spend does end up on the P&L via depreciation.

Depreciation and amortization can get confusing, but at the basic level they are slowly recognizing capital expenditures (since capital isn’t considered an operating expense). A quick example will help. Let’s say we buy a warehouse for $600k. That is a $600k capital expenditure, but we will get the benefit of the warehouse for years to come. Accountants assign an amount of time to recognize this benefit across (say 30 years), then you depreciate the asset (the warehouse) across that time. So $600k cost across 30 years would mean recognizing $20k in depreciation per year.

Financials are not everything, but they are a tool in revealing the truth. And the P&L is just a small but important part of financials. Does the P&L match management’s narrative? Does the P&L match the market’s narrative? If no, why not? Financials lead to questions, not answers. Financials don’t run a business. The financials are a representation of the business. They are a tool for investors, but not the only tool. The P&L really only does two things: backs up the narrative (of the market, management, etc…) and creates questions (i.e why are margins declining?). Nobody can understand a business from solely looking at a P&L, but nobody can understand a business without looking at one either.

Stitch Fix is a great example of how financials can back up a narrative. When I first heard of Stitch Fix, I was skeptical (at best). Stitch Fix is going to hand-pick low margin clothing for a customer, ship it to them, have them keep what they like, then ship the rest back? That company is going to make money and keep the customer happy? Sounds like a great way to burn cash as you pay to acquire customers, then burn even more as you fulfill those orders. But then you look at the P&L. Wait? This company is borderline profitable and growing? In addition to the P&L, the balance sheet is relatively clean. What is happening here? I used the financials as a means of checking my beliefs and what I believed didn’t jive with the financials. I reviewed more and realized my initial beliefs were lazy. I was wrong and went long Stitch Fix.

Investing is exploring contradictions in companies and finding the truth. Listen to management talk, read FinTwit, think about the industry and review the financials. Understand the business, then explore the contradictions.