Dot Com 2.0: Going Rich, Not Bankrupt

The market is euphoric. Stupidity is at an all time high. Bears are screaming bubble, while bulls just keep pumping. Is this Dot Com 2.0? Who is right?

A brief history of a few companies from the Dot Com bubble will help set the stage.

- Pets.com – A company selling pet supplies online sold $619,000 in revenue and spent $11.8 million on advertising in its first fiscal year. Advertising created a high profile for the company, but went bankrupt within 12 months of advertising in the Super Bowl.

- VA Linux – A computer company specializing in the linux operating system. Stock mooned 698% above the IPO price in one day!

- WebVan – online grocery delivery… but in 2000. Valued up to $4.8B, but went bankrupt within 18 months.

No doubt, some of these examples ring true to the current market. IPOs are routinely doubling upon listing. The CEO of Snowflake gets paid more than they have in revenue. Bankrupt companies are being pumped. Tesla is up 10x in a little over a year without much changing. This market is a little nuts.

Ok, can this actually be true?$snow revenue per month = $50M$snow ceo compensation per month = $95M https://t.co/zKjFWcWLkU

— fat baby funds (@fatbabyfunds) December 6, 2020

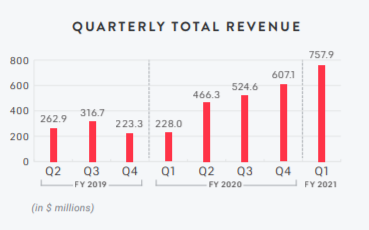

But these are clearly different situations. Follow the free cash flow or what generates free cash flows. Most of the companies that are rallying aren’t going bankrupt. They are going rich. Look at Peloton’s revenue growth. On top of this insane growth, Peloton turned profitable. Going rich, not bankrupt.

I’m not saying this market isn’t stupid. It is. The pumping seems more prevalent than ever. Stimulus checks are being dumped straight into the market. Retail investors are swarming. But this isn’t Dot Com reincarnated. If anything it is a retail bubble that will pop when people start traveling again. But many movements in these stocks are driven by fundamentals. Almost all of these companies are sound financially and won’t be going broke anytime soon. What does this all mean? Who knows, but just keep buying.